Beneficial Ownership Information Reporting

Not sure what your responsibilities are for the new beneficial ownership information report? CorpNet can help.

- Ensure compliance with this new federal mandate

- Securely submit your information with expert guidance

- Stay in compliance with automated reminders

This reporting mandate begins January 1, 2024!

Ready to File Your BOI Report?

In September of 2022, the Financial Crimes Enforcement Network (FinCEN) issued a final rule implementing the bipartisan Corporate Transparency Act’s (CTA) beneficial ownership information (BOI) report. The rule will enhance the ability of government agencies to protect national security and financial systems from illicit use and help prevent drug traffickers, fraudsters, and other criminals from laundering or hiding money in the United States.

The new rule describes who must file a BOI report, what information must be reported, and when a report is due. Specifically, the rule requires Corporations and Limited Liability Companies to file reports that identify the beneficial owners of the entity and the company applicants of the entity.

Key BOI reporting dates to be aware of:

- FinCEN will begin accepting BOI reports on January 1, 2024

- New businesses that are formed on or after January 1, 2024, must file within 90 days of business formation

- Existing businesses that were formed before January 1, 2024, must file before January 1, 2025

Order Your Beneficial Ownership Information Report

Who Needs to File a BOI Report?

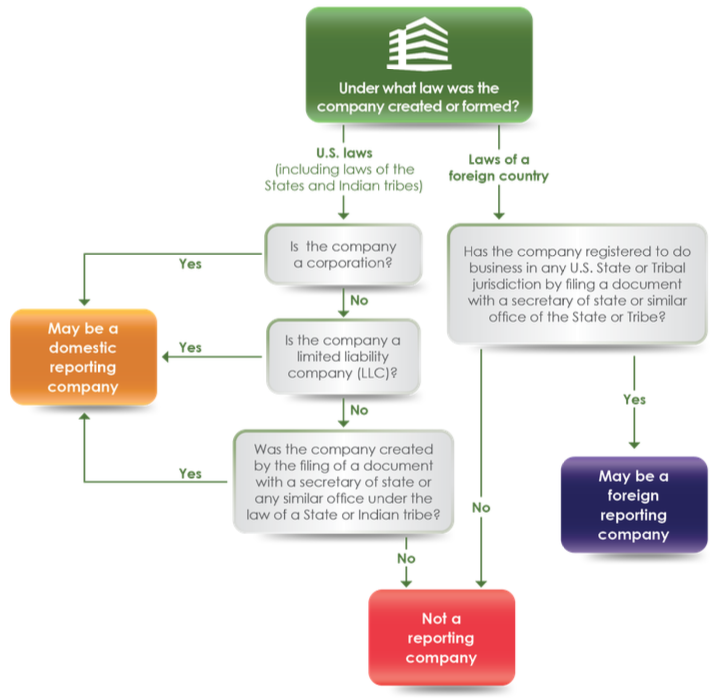

The rule identifies domestic and foreign as the two types of reporting companies that must file a report.

- A domestic reporting company is a Corporation, Limited Liability Company (LLC), or any entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.

- A foreign reporting company is a Corporation, LLC, or other entity formed under the law of a foreign country that is registered to do business in any state or tribal jurisdiction by the filing of a document with a secretary of state or any similar office. Under the rule, and in keeping with the CTA, twenty-three types of entities are exempt from the definition of “reporting company.”

FinCEN expects that these definitions will also include Limited Liability Partnerships, Limited Liability Limited Partnerships, Business Trusts, and most limited Partnerships, because such entities are generally created by a filing with a secretary of state or similar office.

Still have questions? Download our BOI Fact Sheet!

Beneficial Owner Information Report FAQs

What is a beneficial ownership information report?

A beneficial ownership information (BOI) report provides the Financial Crimes Enforcement Network (FinCEN) with information about registered business entities, their beneficial owners (individuals with substantial control over or 25% or more ownership interest), and their company applicants.

How is the beneficial ownership information report connected to the Corporate Transparency Act?

BOI reporting is part of the responsibilities set forth by the Corporate Transparency Act (CTA), enacted in 2021, to establish uniform reporting requirements for business entities. By disclosing personal details about who owns or controls a company, the beneficial ownership report is meant to help identify and prevent illegal activity — such as tax fraud, money laundering, drug trafficking, and financing of terrorism.

Is every company required to file a BOI report?

Most registered business entities meet FinCEN’s definition of a “reporting company.” Reporting companies can be either domestic or foreign.

- Domestic reporting companies are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or with any similar office under the law of a state or Indian tribe.

- Foreign reporting companies are entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.

So, LLCs, C Corporations, S Corporations, and other types of corporations fit the definition. FinCEN doesn’t specifically mention them, but different entity types — such as Limited Partnerships, Limited Liability Partnerships, Limited Liability Limited Partnerships, and Business Trusts — might also be reporting companies.

Businesses, like Sole Proprietorships and General Partnerships, which do not register formation documents, do not have to file a beneficial ownership report.

Who is exempt from the reporting rule?

FinCEN has identified 23 exemption categories. If an entity is in one of those categories and meets its specific exemption criteria, it does not have to submit a beneficial ownership report. The exemptions are primarily for entities already under close regulation by the federal and state governments.

- Securities reporting issuer

- Governmental authority

- Banks

- Credit unions

- Depository institutions holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agencies

- Other Exchange Act registered entites

- Investment companies or investment advisers

- Venture capital fund advisers

- Insurance companies

- State-licensed insurance producers

- Commodity Exchange Act registered entities

- Public utilities

- Financial market utilities

- Pooled investment vehicles

- Tax-exempt entities

- Entity assisting a tax-exempt entities

- Large operating companies

- Subsidiary of certain exempt entities

- Inactive entities

- Public accounting firms registered in accordance with section 102 of the Sarbanes-Oxley Act of 2002 (15 U.S.C. 7212)

Simply falling into any of these categories does not automatically make a reporting company exempt. Each category has specific criteria that must be met to qualify for exemption. Refer to FinCEN’s Small Entity Compliance Guide for details.

When are beneficial ownership reports due?

FinCEN will begin accepting BOI reports on January 1, 2024. Deadlines depend on when a reporting company was created or registered.

- Reporting companies created or registered to do business before January 1, 2024 – Initial BOI report is due by January 1, 2025.

- Reporting companies created or registered on or after January 1, 2024 and before January 1, 2025 – Initial BOI report is due within 90 days of the entity’s formation.

- Reporting companies created or registered on or after January 1, 2025 – Initial BOI report is due within 30 days of the entity’s formation.

Who is a beneficial owner of a reporting company?

A reporting company’s beneficial owner is any individual who owns or controls 25% or more of the ownership interests of a reporting company or who directly or indirectly exercises substantial control over the entity.

Some types of individuals do not count as beneficial owners:

- An employee (not in a senior position) whose control or economic benefits from the reporting company are derived solely from their activities as an employee.

- An individual who has only a future ownership interest through a right of inheritance (once they inherit the interest, they must be reported)

- A custodian, nominee, intermediary, or agent of another individual who meets the beneficial owner definition

- A minor child (information about a parent or guardian must be reported instead)

- Creditors of the reporting company

What is considered an ownership interest?

Any individual who owns or controls at least 25% of the ownership interests in a reporting company is considered a beneficial owner.

An ownership interest may be any of the following:

- Equity

- Stock

- Capital or profit interest

- Voting rights

- Any instrument convertible into stock, equity, voting rights, or capital or profit interest

- Options or other non-binding privileges to buy or sell any of the interests mentioned above

- Any other contract, instrument, or mechanism to establish ownership

What does “substantial control” over a reporting company mean?

An individual has substantial control if they: 1) Are a senior officer (e.g., CEO, CFO, COO, or other executive level position with a high degree of authority); 2) Have the authority to appoint and remove senior officers and members of the board of directors or other governing body; or 3) Make, direct, or influence the company’s important decisions.

Important decisions could include those concerning things like reorganizations, mergers and acquisitions, making amendments to the company’s governance documents, adding or removing lines of business, expanding into different markets, determining senior officers’ compensation structures, dissolving the business, entering into contracts, and selling or leasing principal assets, etc.

What are some examples of substantial control?

Substantial control might be direct or indirect.

Examples of direct substantial control include:

- Serving on the reporting company’s board of directors

- Owning or controlling a majority of voting power or voting rights

- Having rights associated with financing or interest

Examples of indirect substantial control include:

- Controlling any intermediary entities that exercise substantial control over a reporting company

- Having financial or business relationships with other entities or individuals acting as nominees

Is there a limit to how many beneficial owners we have to report?

Reporting companies must identify ALL individuals who meet the definition of a beneficial owner and do not qualify as an exception to the reporting rule.

Who is a company applicant?

A company applicant is a person who physically or electronically files a business registration application with the state to form an LLC, Corporation, or other legal entity or who files an application to register a non-U.S. to conduct business in the United States.

If more than one individual is involved in the reporting company’s formation filing process, both the person who directly filed the formation document and the individual who helped direct or control the filing must be included in the BOI report.

Does every reporting company have to identify a company applicant?

No. Only domestic reporting companies created on or after January 1, 2024 and foreign reporting companies first registered to do business in the U.S. on or after January 1, 2024 must include their company applicants in their BOI report.

What details must we include about our company and its beneficial owners and company applicants?

Reporting companies must include the following information about their business entity:

- Legal name

- DBAs or trade names

- A principal business address in the U.S.

- Formation or registration jurisdiction (state, tribal, or foreign)

- Federal taxpayer ID number (TIN, Social Security Number, EIN)

The information they must provide about their beneficial owners and company applicants include:

- The individual’s full legal name

- Date of birth

- Residential street address (Company applicants may use the business address in some instances).

- Personal identification number and issuing jurisdiction from a non-expired U.S. passport, state driver’s license, or other ID document issued by a state, local government, or tribe — also an image of the ID document. (Individuals may use a foreign passport if they don’t have any other forms of ID.)

To streamline the report filing process, reporting companies, beneficial owners, and company applicants can obtain a FinCEN identifier, which eliminates the need to enter some of the specific details within the BOI report.

What is a FinCEN ID number?

A FinCEN identifier is a unique number assigned upon request to a reporting company, beneficial owner, or company applicant. Reporting companies can use FinCEN identifiers to simplify and streamline completing their BOI forms. No one is required to obtain a FinCEN identifier.

A reporting company can request one by checking the designated box on its BOI report. Individuals may request a FinCEN identifier through an electronic application.

How do I report my company’s beneficial ownership information?

You’ll file your BOI report through FinCEN’s secure filing system, which will be available starting January 1, 2024. From that date forward, you can find instructions and technical guidance in the BOI section of the FinCEN website.

Do I have to file a BOI report every year?

No. However, if information about your reporting company or its beneficial owners has changed, you may have to issue an updated report.

What if any information on our BOI report has changed or we made a mistake?

FinCEN requires reporting companies to file an updated report within 30 calendar days of when a relevant change occurs or when they realize they provided inaccurate information in their BOI report.

Are there penalties for not reporting beneficial ownership information?

Indeed, there are! There could be civil penalties of up to $500 per day for each day a BOI report is late. Willful failure or attempt to provide false or fraudulent beneficial ownership information could bring criminal penalties, including imprisonment for up to two years and/or a fine of up to $10,000.

What happens if an exempt company files a BOI report? Is there a downside?

Other than being unnecessary and reducing privacy, there is no real downside.

How will FinCEN use my information? Do they share it with anyone else?

FinCEN will keep all the information it collects in a secure database. The information will not be publicly available. Federal, state, local, tribal, and foreign government officials may request to obtain beneficial ownership information for authorized activities related to national security, intelligence, and law enforcement. If the reporting company consents, financial institutions may have access to beneficial ownership information under certain circumstances.

How can I get help with our BOI report?

Ultimately, reporting companies are responsible for filing their beneficial ownership information report and certifying the information is complete and correct. Any individual who files the BOI report as an agent of the reporting company certifies it on the entity’s behalf.

If you need help determining whether you must file a BOI report or identifying who must be reported as beneficial owners or company applicants, consider getting guidance from an accountant or attorney.

And if you don’t feel confident preparing and filing the report on your own, CorpNet is here to act as your agent and file the report on your company’s behalf.

What If Scenarios for BOI Reporting

If you have an association (like a homeowner’s association) where no stock or ownership of the corporation exists, would all of the board of directors be beneficial owners?

Reporting would be required for anyone who exercises substantial control of the entity or owns/controls more than 25% of the ownership interests.

If Company A, is equally owned by Corporation B and Corporation C, and Corporation B and C are subsequently owned by an individual, is Company A required to file a BOI report or only Corporations B and C?

Company A would be required to file a BOI report, and the beneficial owner would be the individual who owns Company B and C. Beneficial owners are individuals unless the entity is solely owned by an exempt entity.

Would a husband and wife-owned LLC or Partnership that is disregarded for tax purposes (income and expenses reported on Schedule C) be considered beneficial owners for BOI reporting?

Married spouses are considered separate beneficial owners for purposes of the BOI report, so both would need to be included.

Are spoused considered beneficial owners in a community property state where a single member LLC owner is married?

No, only the actual person controlling the business operations would be listed on the report.

What happens if an existing reporting company has a change in ownership prior to filing its initial BOI report in late 2024? Does the initial report need to include any information about the owners who sold their interests in early 2024?

The initial BOI report should be the most current information. If the information changes before the report is filed, the old information doesn’t need to be reported. If the information changes after filing the report, an amended report can be filed.

Would a Public Benefit Corporation be required to submit a BOI report?

If a Public Benefit Corporation has tax exempt approval under Section 501(c) of the Internal Revenue Code of 1986, they are not required to file a BOI report.

Is a Sole Proprietorship who files a Schedule C Profit and Loss From Business tax form, and is registered with a state, required to file the BOI report?

Yes. In this case, they would be required to file a BOI report.

In a single-member LLC that is taxed as a Sole Proprietorship required to file a BOI report?

Yes, they are required to file a BOI report because they are formally registered with the Secretary of State.

Is a business created as a county registered DBA required to file a BOI report?

No. This type of business is not required to file.

Which accounting firms are not required to file a BOI report?

An entity that is a public accounting firm registered in accordance with section 102 of the Sarbanes- Oxley Act of 2002 is exempt from BOI reporting. All other accounting firms should file a BOI report.

Is a single-member LLC that provides accounting services exempt from BOI reporting?

No. An LLC that provides accounting services is only exempt if it meets the accounting exemption requirement, which is an entity that is a public accounting firm registered in accordance with section 102 of the Sarbanes-Oxley Act of 2002.

If a tax professional files a BOI report on behalf of a tax client, is the tax professional considered the company applicant?

No, the company applicant is the person who actually formed the entity with the Secretary of State.

Are S Corporations or companies owned by multiple trusts exempt?

S Corporations and entities owned by trusts are still required to file. The only reason for not reporting would be related to other exemption criteria.

What information is required if the owner of a reporting company is another private or publicly traded company?

An individual is required to be listed as a beneficial owner unless the reporting company is owned by an exempt entity. If the owning entity is not exempt, then by default, the individual beneficial owners of that entity would also be the beneficial owners of the reporting company.

Does a trust that owns rental properties for multiple beneficiaries have to file?

Trusts are exempt if they meet the requirements in paragraph 1 or 2 of the Internal Revenue Code section 4947.

What if the beneficial owner is an irrevocable trust? Do you disclose the trust grantor the trustee or the beneficiaries of the trust?

Trusts are exempt if they meet the requirements in paragraph 1 or 2 of the Internal Revenue Code section 4947.

Regarding exemptions, what qualifies as an inactive entity?

An inactive entity is an entity that was in existence on or before 1/1/2020, is not engaged in any active business, is not owned by a foreign person, has not experienced any change in ownership in the preceding 12-month period, has not sent or received any funds of more than $1,000 in the prior 12 month period, and does not otherwise hold any kind or type of assets either in the USA or abroad, including ownership in another entity.

What do we report as our main place of business when all employees work from home, and we have no office or main place of business?

The location where most business is conducted should be used. It must be a physical, USA address.

If the company closes on or before December 31, 2023, do you have to file this BOI?

No. You do not need to file a BOI report in 2024.

Do you need to file a BOI report for an inactive entity in existence before January 1, 2024, but planning to become active during 2024?

If an entity is formally dissolved with the Secretary of State, a BOI report is not required. If the entity is not formally dissolved, it must meet the inactive company requirements to be exempt. If it does and a BOI report is not filed, once activity resumed, a BOI report would be required.

What will happen if a domestic corporation closes its physical USA office and has employees working remotely? Would this entity qualify for the exemption?

If the entity formally dissolved the company with the Secretary of State on or before December 31, 2023, a BOI report would not be required.

Are Limited Partnerships exempt from BOI reporting?

Generally, Limited Partnerships are formed by filing documents with the Secretary of State or similar office. If this is the case, they are required to file a BOI report.

Are these forms required to be electronically filed or paper filed?

They can be filed online or via paper. Online filings are much simpler and receive automatic feedback.

Are VCs considered beneficial owners?

Any individual who directly or indirectly has 25% or more ownership in the entity and/or exercises substantial control over the entity is considered a Beneficial Owner.

Can you use an existing FinCEN identifier that has been used for FBARs (FinCEN 114)?

FinCEN identifiers issued by the FinCEN after filing a BOI can be used for filing BOIs for other entities where they have the same beneficial owner. FinCEN Identifiers issued from other reporting requirements are not valid.

Are nonprofits owning a C Corporation required to file?

If a nonprofit meets the tax exempt entity requirements, it is not required to file a BOI report. With the exception of money services business, pooled investment vehicles, and entities assisting a tax exempt entity, entities that are not tax exempt and wholly owned or controlled, either directly or indirectly, by any other exempt entity qualify for BOI reporting exemption.

Are Partnerships who file Form 1065 considered a reporting company?

Any Corporation, LLC, or other entity that was created by the filing of a document with the Secretary of State or other similar office in the USA is required to file a BOI, unless it meets one of the 23 exemptions.

Will single-member LLCs who do not have an EIN need to obtain an EIN in order to file their BOI

report?

Yes.

Does a company sold in 2023 have to file?

The company itself, if still active, is required to file a BOI Report, but this report would be required by the new beneficial owners.

Does an SMLLC use their SSN or EIN?

The EIN is required.

How does a Delaware LLC that is owned by an international company and has a single individual owner file?

The beneficial owner is required to be an individual, so the individual who owns the international company, by default, also owns the Delaware LLC and would be the beneficial owner.

I have an S Corporation that owns 100% of another S Corporation. Do both companies file a BOI report?

Yes, both companies would be required to file BOI reports. Beneficial owners are required to be individuals, so whoever owns the owning entity, by default are beneficial owners.

If I have an S Corporation that has remote employees in another state, does the BOI need to file as a foreign entity?

Foreign entity BOI reports are for entities doing business in the USA but not registered here. Only one BOI Report is required for a single entity, regardless of how many foreign qualifications they have.

If my company is registered to do business in multiple states, do I need to file the BOI report for each state?

No. If they are all filed as foreign qualifications, only one BOI Report is required for the domestic state.

If there are two members in an LLC, and one has 1% ownership but all the voting rights, and the other has 99% but no vote, are they both beneficial owners?

Yes.

Is a foreign company one that is registered in a foreign country or operating in another state other than the home state?

In terms of BOIs, a foreign company is registered in another country and outside the USA.

Is a 100% owned subsidiary (S2) of a 100% owned subsidiary (S1) of a company that trades with ADRs (P) exempt based on the parent being publicly traded?

With the exception of money services business, pooled investment vehicle, and entities assisting a tax exempt entity, business entities who are wholly owned or controlled, either directly or indirectly, by any other exempt entity qualify for BOI reporting exemption.

Is a firm with over 20 employees and over $5,000,000 in revenue exempt from the reporting?

To meet the large operating company exemption, the entity must employ more than 20 full-time employees, more than 20 of the full-time employees must be employed in the USA, the entity must have an operating presence at a physical office in the USA, have filed a federal income tax or information return for the previous year demonstrating more than $5,000,000 in gross receipts or sales, report more than $5,000,000 in gross receipts or sales on the entity’s IRS Form 1120 or other equivalent, and the gross receipts or sales amount must remain greater than $5,000,000 after excluding gross receipts or sales from sources outside the USA.

Is renewing a driver’s license a change requiring resubmission?

No, changes requiring reporting would be anything that changes in the report itself, such as a change of beneficial ownership, a change in the name of a beneficial owner, etc.

My synagogue is a New York Corporation. Will it need to file a BOI? If the Board of Trustees changes nearly every year, would we need to resubmit each year?

Unless it meets one of the 23 exemptions, yes a BOI Report would need to be filed once (Initially) and every time a change is made.

What if an LLC has a member that is an IRA? Will the owner of the IRA be the beneficial owner of the company?

Yes, the individual owner of the IRS will be the beneficial owner of the entity filing the BOI.

Are incorporated nonprofits such as section 507 clubs or 501c3 entities required to file?

If the entity meets the tax exempt entity exemption, they are not required to file a BOI. To meet the exemption, they must meet any one of the following criteria:

- It is an organization that is described in section 501(c) of the Internal Revenue Code of 1986 (determined without regard to section 508(a) and exempt from tax under section 501(a).

- It is an organization described in section 501(c) of the Code and was exempt from tax under section 501(a) but lost its tax-exempt status less than 180 days ago.

- It is a political organization, as defined in section 527(e)(1) of the Code, that is exempt from tax under section 527(a). or

- It is a trust, as described in paragraph 1 or 2 of Internal Revenue Code section 4947.

What if a partnership has 20 members with each member owning 5% of the partnership? Are all the members considered beneficial owners?

Beneficial owners are individuals with 25% or more ownership in an entity or an individual who has substantial control over the operations of an entity (meaning they are a senior officer), they have the authority to appoint or remove officers, directors or similar capacity titles, they are an important decision maker, or they have any other form of substantial control over the entity

What if the person does not have any form of ID?

A form of ID is required, it can be a state-issued drivers license, state-issued ID, valid USA passport or valid foreign passport if none of the others are available. If the beneficial owner is a minor, their parent or guardian would be listed on their behalf.

What if the person who originally formed the entity with the Secretary of State is no longer associated with the reporting entity?

The person who originally formed the entity is only required for entities formed on or after 1/1/2024. If your entity was formed prior to this date, the company applicant, or person that formed the entity, is not required to be reported/listed.

Would a company have to fill out the BOI reporting form for every state where they have a location?

No, only one BOI report is required for the domestic state.

Why Choose CorpNet for Your BOI Report?

At CorpNet, we understand that your BOI report is a crucial step in maintaining successful business compliance. CorpNet can file your BOI report for $99 per entity, but the value you receive from choosing CorpNet goes beyond a simple transaction. Here’s why we stand out:

Data Security

Unlike some other online filing companies, with CorpNet you can rest assured that your information is safe, private, and never shared or sold.

Unsurpassed U.S. Customer Service

Your satisfaction is our top priority, so we strive for superior customer service. Our dedicated U.S. team is here to assist you at every step, ensuring that your experience with CorpNet is smooth and stress-free. Unlike other filing companies, we won’t put you in a box with chatbots and slow support tickets. If you prefer to speak with a human, one of our dedicated filing experts is here to answer your call.

Comprehensive Business Filing Support

CorpNet is more than a business formation and filing service, and your business is more than a simple transaction. Other companies focus only on the transaction, but we are committed to supporting you throughout the entire lifecycle of your business. From initial business name checks and entity formation to registered agent services, payroll tax registration, and BOI reports, we aim to be your trusted business filing partner.

100% Satisfaction Money-Back Guarantee

We believe in the quality of our service. That’s why we offer the industry’s best 100% satisfaction money-back guarantee. If you are not 100% satisfied with our services, we will refund 100% of our service fees, no questions asked! Please see our CorpNet Guarantee for details.

Easiest Ordering Experience

We’ve designed our ordering process to be the easiest in the business. Streamlined and user-friendly, our platform allows you to complete the necessary steps with minimal effort, saving you time and ensuring accuracy. And if you ever have questions, our team of U.S. filing experts is here to help you – over the phone, via email, or on chat.