IRS Form 8832 (Entity Classification Election) is the form an eligible business entity uses to elect federal income tax treatment other than its default treatment.

Eligible entities include:

- Limited Liability Companies (LLCs)

- Partnerships (a business entity that has at least two members and is not a corporation)

According to the IRS, a corporation is usually not considered an eligible entity unless:

- It is an eligible entity that previously submitted Form 8832 to be an association taxable as a corporation. The IRS may then allow it to use Form 8832 to change its classification.

- It is an existing foreign eligible entity in existence before January 1, 1997 that is classified as an association taxable as a corporation. The IRS may then allow it to use Form 8832 to change its classification.

Default Federal Income Tax Treatment

Before we discuss how the filing of Form 8832 changes things for eligible entities, let’s first review what the default tax treatment looks like for those entity types.

Limited Liability Companies (LLCs)

By default, the IRS will treat an LLC with one member (single-member LLC) as a disregarded entity, not separate from its owner for tax purposes. The business’s profits and losses flow through to the owner’s individual income tax return – Form 1040 with Schedule C (Profit or Loss from Business (Sole Proprietorship).

By default, the IRS will treat a multi-member LLC (an LLC with at least two partners) as a partnership. All profits and losses pass through to its owners’ personal income tax returns. The business must submit an annual informational return (Form 1065, U.S. Return of Partnership Income). An entity treated as a partnership must also complete a Schedule K-1 (Partner’s Share of Income Deductions, Credits, etc.) for each partner to document each individual’s share of the partnership’s incomes, gains, losses, deductions, credits, and liabilities.

Partnerships

By default, the IRS will pass a partnership’s profits and losses through to the owners’ personal income tax returns (Form 1040). A partnership must provide a Schedule K-1 to each partner to identify each individual’s share of the business’s profits and losses.

Electing Alternate Tax Treatment With Form 8832

If an eligible entity wants to change—or change back to—its default tax treatment, it may file IRS Form 8832. By using Form 8832, a business chooses to be taxed as one of the following:

- A corporation

- A partnership

- An entity disregarded as separate from its owner

I’ve already covered how disregarded entities and partnerships are taxed, so let’s now discuss what electing taxation as a corporation means.

Choosing that election means that a partnership or LLC requests to be taxed as a C Corporation. As such, it will be treated as an independent tax-paying entity and required to file its own tax return (Form 1120, U.S. Corporation Income Tax Return) and pay income tax on its taxable income at the corporate income tax rate. You’ll often hear a C Corporation’s income tax treatment referred to as “double taxation.” This is because the corporation pays taxes on its profits. Then every owner (shareholder) pays taxes on the dividend income (already taxed at the corporate level) they receive from the business. Note that dividend payments to shareholders are not a deductible expense for the corporation.

Who Is Required to File Form 8832?

According to the current IRS Form 8832 instructions, an entity must submit 8832 if it is:

- A domestic entity electing to be classified as an association taxable as a corporation

- A domestic entity electing to change its current classification (even if it is currently classified under the default rule)

- A foreign entity that has more than one owner, all owners having limited liability, electing to be classified as a partnership

- A foreign entity that has at least one owner that does not have limited liability, electing to be classified as an association taxable as a corporation

- A foreign entity with a single owner having limited liability, electing to be an entity disregarded as an entity separate from its owner

- A foreign entity electing to change its current classification (even if it is currently classified under the default rule)

According to the IRS, an eligible entity should not file Form 8832 if they are:

- Tax-exempt under section 501(a)

- A real estate investment trust (REIT)

- Electing to be classified as an S corporation (IRS Form 2553 is used for that purpose.)

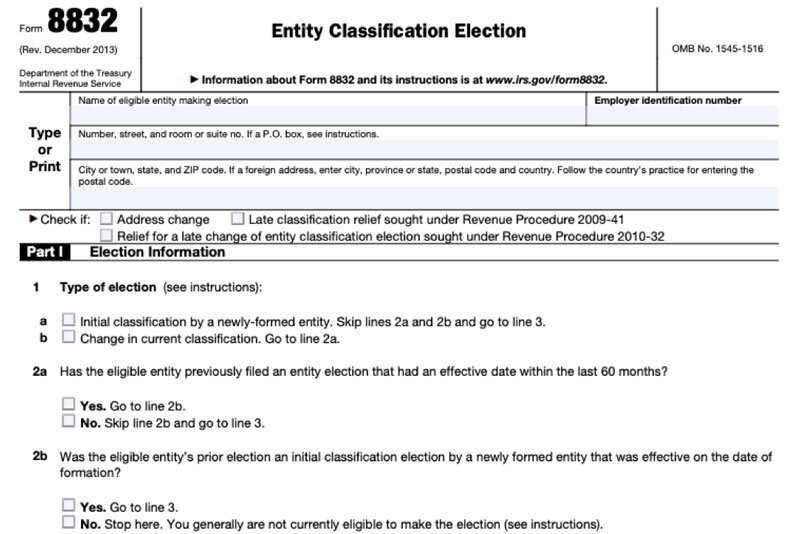

Information and Questions on Form 8832

Business owners should consult an accountant or tax advisor who can help them decide which tax classification will be most advantageous. Form 8832 is not overly complicated, but it needs to be completed accurately. Along with assisting you with other critical business filings, my team at CorpNet can also help you with Form 8832.

Below is a summary of what the IRS requests on Form 8832. The IRS provides detailed instructions for each element on the form. The form can be completed online and then downloaded or printed.

- General Information

- Entity name and address

- Employer Identification Number (EIN)

- Election Information

-

- Type of election

- Initial classification by a newly formed entity

- Change in g current classification

- Has the entity previously filed an entity election with an effective date within the last 60 months?

- Was the entity’s prior election an initial classification, effective on the date of formation, by a newly formed entity?

- Does the entity have more than one owner?

- Name and tax ID of the owner, if the entity has just one owner

- Name and EIN of the parent corporation, if the entity is owned by one or more affiliated corporations

- Type of entity and election (provides a list of six to choose from)

- Foreign country of organization, if the entity is created or organized in a foreign jurisdiction

- The effective date of the election

- Name, title, and the phone number of the contact person for the entity

-

- Consent Statement and Signatures

- Late Election Relief – If applicable, an explanation of why the entity didn’t file Form 8832 on time

Who Must Sign It

In August of 2020, to lessen the risk of COVID-19 transmission to taxpayers and tax professionals, the IRS announced that it would temporarily allow the use of digital signatures on Form 8832 and other forms that cannot be filed electronically. The IRS does not specify which digital signature product tax professionals must use to obtain their clients’ signatures.

When to File

An eligible business may file Form 8832 when it first forms the entity or at any time during its existence.

While there’s no “deadline” per se, the IRS restricts how far in advance or after filing Form 8832 that a business’s tax classification change will take effect.

Generally, a business cannot request an effective date that is more than 75 days before the date that it filed Form 8832. Also, the IRS will typically not allow the tax classification to take effect later than 12 months after the election is filed. Under some circumstances, the IRS may grant an eligible entity late election relief.

The IRS only allows eligible entities to change their tax classification once every 60 months. This limitation does not apply to a newly formed business that filed a Form 8832 that was effective on its formation date. Also, the IRS might permit an entity to change its tax classification before the 60-month period if more than 50 percent of its ownership interests, as of the effective date of the election, are owned by persons who didn’t have any interests in the entity on the effective or filing date of the earlier election.

Where to Send Form 8832

The completed form must be sent to the appropriate IRS center.

An entity’s state determines the address to which they should send their completed and signed Form 8832. The information below reflects the IRS mailing addresses at the time of this writing. Because IRS mailing addresses and instructions may change in the future, I recommend checking their website for the most current version of Form 8832 to confirm the correct destination address before sending the form.

If they are in one of the following states, taxpayers should send Form 8832 to Kansas City, MO:

- Connecticut

- Delaware

- District of Columbia

- Georgia

- Illinois

- Indiana

- Kentucky

- Maine

- Maryland

- Massachusetts

- Michigan

- New Hampshire

- New Jersey

- New York

- North Carolina

- Ohio

- Pennsylvania

- Rhode Island

- South Carolina

- Vermont

- Virginia

- West Virginia

- Wisconsin

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

If they are in one of the following states, taxpayers should send Form 8832 to Ogden, UT:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Hawaii

- Idaho

- Iowa

- Kansas

- Louisiana

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Oklahoma

- Oregon

- South Dakota

- Tennessee

- Texas

- Utah

- Washington

- Wyoming

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201

How CorpNet Can Help

After you’ve discussed the optimal tax classification for your business, we will ensure your Form 8832 (or Form 2553, if electing S Corp tax treatment) is completed accurately and on time.

With our help, you can have peace of mind whenever you have to make a critical business formation or compliance filing. Our team of filing experts works with entrepreneurs in all 50 states, providing personalized attention and exceptional service. Contact us today!

Sources:

https://www.irs.gov/forms-pubs/about-form-8832

https://www.irs.gov/newsroom/irs-approves-temporary-use-of-e-signatures-for-certain-forms

https://www.irs.gov/pub/irs-pdf/f8832.pdf