IRS Form 2553 (Election by a Small Business Corporation) is the form that a corporation (or other entity eligible to be treated as a corporation) files to be treated as an S corporation for federal tax purposes.

The IRS has specific criteria that entities must meet to qualify for the S Corporation election. Here’s an overview of their requirements:

- Must be a domestic corporation or a domestic entity eligible to elect to be treated as a corporation

- Must timely file Form 2553

- Must have no more than 100 shareholders (or LLC members).

- Shareholders are individuals, estates, exempt organizations (per U.S. Tax code Sections 401(a) or 501(c)(3)), or certain trusts

- Must have no nonresident alien shareholders

- Only one class of stock

- Isn’t an ineligible corporation (e.g., bank or thrift institution that uses the reserve method of accounting for bad debts under U.S. Tax Code Section 585, an insurance company subject to tax under subchapter L of the Code, or an existing or former domestic international sales corporation (DISC)

- Will use one of the following tax years:

- A tax year ending on December 31

- A natural business year (a period of twelve months for which a company prepares its accounts based on its typical levels of activity, starting and ending when activity is low)

- An ownership tax year (a tax year that coincides with the tax year used by shareholders holding more than 50% of the corporation’s stock on the first day of the requested tax year)

- A tax year elected under Section 444 of the U.S. Tax Code (requesting to use a tax year other than one required)

- A 52-53-week tax year (a fiscal tax year that varies from 52 to 53 weeks but does not have to end on the last day of a month) ending with reference to a year listed above

Potential Tax Benefits of Filing Form 2553

The primary reason eligible C Corporations and Limited Liability Companies file Form 2553 is to improve their tax outcomes.

C Corporation Tax Advantages

By default, a C Corporation is a tax-paying entity separate from its owners (shareholders). It is required to pay tax (at the corporate rate) on its taxable income and file its own tax returns (Form 1120, U.S. Corporation Income Tax Return). Some of the C Corporation’s income undergoes “double taxation” when it distributes dividends to its shareholders. Even though the federal government already taxes those business profits at the corporate level, the individual shareholders must also report and pay tax (either as ordinary dividends or qualified dividends) on that income on their personal tax returns.

Alternatively, with S Corporation tax treatment, a corporation avoids double taxation. Its income and losses directly pass through to its shareholders’ tax returns. The business’s taxable income gets reported and taxed on the shareholders’ personal tax returns rather than reported through a corporate income tax return. While the S Corporation does not pay income tax at the corporate level, it must still submit an informational return using IRS Form 1120S. It must also provide each of its individual shareholders with a Schedule K-1 (Shareholder’s Share of Income, Deductions, Credits, etc.) to report their share of the S Corporations earnings.

LLC Tax Advantages

By default, an LLC’s profits, losses, and income tax responsibilities pass through to its owners (members). Single-member LLCs are treated as sole proprietorships—with the owner filing IRS Form 1040 (U.S. Individual Income Tax Return) and Schedule C (Profit or Loss From Business). Multi-member LLCs are treated as general partnerships. Taxes flow to their owners, who each file Form 1040 along with the Schedule K-1 (Partner’s Share of Income, Deductions, Credits, etc.) provided to them by the LLC. Although the LLC does not report and pay taxes of its own, it must file an informational return (IRS Form 1065, U.S. Return of Partnership Income). LLC members, whom the company may not put on its payroll, must pay self-employment taxes (Medicare and Social Security) on all of the business’s profits. Generally, LLC members must pay their income tax and self-employment taxes through quarterly estimated payments throughout the year.

Some business owners may find that having all taxable income subject to income tax and self-employment taxes adds up. Hence, they chose the S Corporation election instead. Filing form 2553 and getting S Corp tax treatment can help reduce the Medicare and Social Security tax burden on LLC owners. As an S Corporation, the company still enjoys the simplicity of pass-through taxation. However, LLC members who work in the business are put on the company payroll. Only their wages and salaries are subject to Social Security and Medicare taxes (called FICA), half of which gets deducted from the individual’s paychecks. The LLC pays the other half. Any remaining business profits the LLC members receive as distributions are subject to income tax but not to self-employment tax.

Information and Questions on Form 2553

Business owners should consult an accountant or tax advisor to help them decide if the S Corporation election will be beneficial. Form 2553 is not overly complicated, but it needs to be completed accurately. The IRS provides detailed instructions for completing Form 2553, which may help.

However, filling out the form can be both time-consuming and confusing for people not familiar with it. Along with assisting you with other critical business filings, my team at CorpNet can also help you properly obtain S Corp election status by preparing and filling out Form 2553 on your behalf.

Below is some of the key information the IRS requests on the form. The form can be completed online and then downloaded or printed before it is mailed or faxed to the IRS.

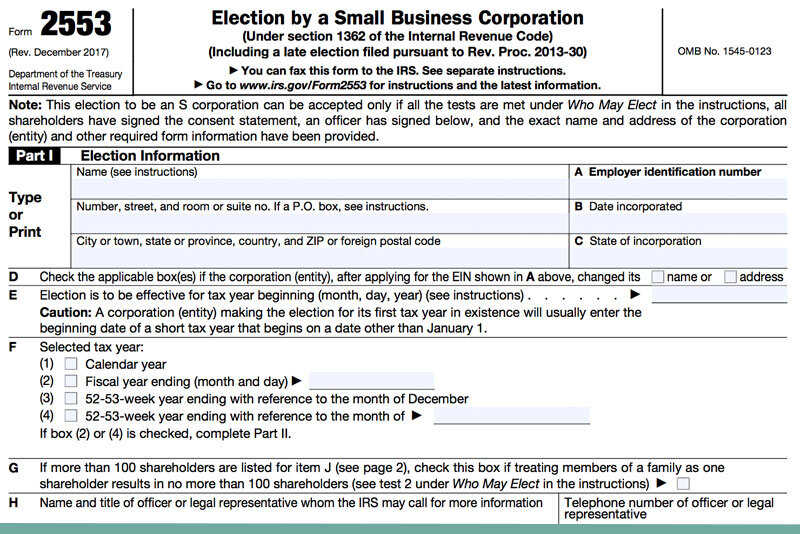

Part 1. Election Information

- Legal name and address of the eligible business entity

- The business entity’s Employer Identification Number (EIN)

- Date of incorporation

- State of incorporation

- Tax year for when the election is to be effective

- Tax year the S Corp will use

- Name and title of an authorized person whom the IRS may call for more information

- Explanation if the election will be filed late

- Signature of an authorized individual (the president, vice president, treasurer, assistant treasurer, chief accounting officer, or any other corporate officer who is authorized to sign)

- Shareholder consent statement, signed by all shareholders required to agree to the election

Part 2. Selection of Fiscal Tax Year

Additional information about the entity’s tax year selection (required when an entity, in Part 1, selects a tax year that’s a fiscal year ending on a chosen month and day or a 52-53-week year ending with reference to a chosen month)

Part 3. Qualified Subchapter S Trust (QSST) Election Under Section 1631(d)(2)

Information about any trusts that are qualified shareholders of the S Corporation

Required Signatures

The IRS requires that Form 2553 be signed and dated by a corporate officer of the entity. The IRS will not consider the form timely filed if an authorized individual does not sign it.

Other corporate shareholders that are required to consent to the election must be listed on Form 2553. Each of those individuals must confirm their consent by signing and dating the appropriate section on Form 2553 or a separate consent statement.

Filing Deadlines

Generally, businesses must file Form 2553 no later than two months and 15 days after the requested effective date they entered in Part 1 of the form. If they want it effective for the following tax year, they may file it at any time during the current tax year.

A late S Corp election form will typically be effective for the tax year following the tax year beginning on the date entered in Part 1 (line E) of Form 2553. However, relief for a late election may be available if the corporation can show it had reasonable cause for failing to file on time.

Submission Instructions

The completed form must be sent or faxed to the appropriate IRS address.

An entity’s state determines the address to which they should send their completed and signed Form 2553. The information below reflects the IRS mailing addresses at the time of this writing. Because IRS mailing addresses and instructions may change in the future, I recommend checking their website for the most current version of Form 2553 to confirm the correct destination address and fax number before sending the form.

If they are in one of the following states, taxpayers should send Form 2553 to Kansas City, MO:

- Connecticut

- Delaware

- District of Columbia

- Georgia

- Illinois

- Indiana

- Kentucky

- Maine

- Maryland

- Massachusetts

- Michigan

- New Hampshire

- New Jersey

- New York

- North Carolina

- Ohio

- Pennsylvania

- Rhode Island

- South Carolina

- Vermont

- Virginia

- West Virginia

- Wisconsin

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

Or submit by Fax: 855-887-7734

If they are in one of the following states, taxpayers should send Form 2553 to Ogden, UT:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Hawaii

- Idaho

- Iowa

- Kansas

- Louisiana

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Mexico

- North Dakota

- Oklahoma

- Oregon

- South Dakota

- Tennessee

- Texas

- Utah

- Washington

- Wyoming

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

Or submit by fax: 855-214-7520

The IRS will notify the entity whether it has accepted or rejected the election. If accepted, the IRS will also confirm the date when the election will take effect. Generally, the entity should hear from the IRS within 60 days after filing Form 2553. The IRS recommends that the entity contact them at phone number 1-800-829-4933 if it doesn’t receive notification about the election within two months of the filing date. Note that it may take up to five months for a response if the entity requested a tax year based on business purpose (on Part 2 of Form 2553).

Do You Need to File Form 2553 Each Year?

No. After the election is approved, it stays in place unless the business changes its election or the IRS revokes it.

Let CorpNet Help You

Have you talked with your trusted legal and tax professionals about whether the S Corporation election might be right for your business? If yes, and you’ve made an informed decision to move forward, my team at CorpNet is here to help you take the next step!

Save precious time, avoid errors, and file on time by enlisting our expert assistance in preparing and filing your Form 2553. Contact us today to get started!

Sources:

https://www.irs.gov/forms-pubs/about-form-2553

https://www.irs.gov/instructions/i2553

https://www.irs.gov/pub/irs-pdf/f2553.pdf

Need Help Requesting S Corporation Status?

By having CorpNet prepare your S Corporation election request you’ll save both time and money with services that are fast, reliable, and affordable. And our services are backed by a 100% satisfaction guarantee, so you know you’re in good hands.