Whether you’re a business accountant serving entrepreneurs or you’re a business owner, it’s critical to understand sales and employment tax registration and ongoing requirements. Federal payroll taxes are the same no matter where a business is located, but state employment taxes and sales taxes differ according to tax rates in the various states.

I presented a webinar for CPA Academy on this topic, and this blog article will cover what I discussed. So, get ready for a lot of helpful info about various types of employment taxes, payroll tax registration and processing, sales and use tax, registering for and paying sales tax.

And remember, our team can assist in getting your business up and running quickly. We offer payroll tax registration and sales tax registration services to help make the startup process as easy as possible.

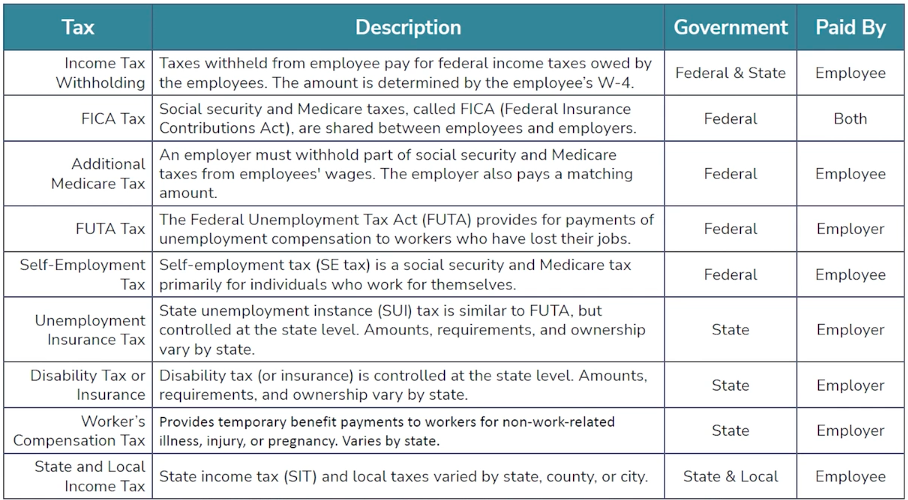

Type of Employment Taxes

Business owners and their employees are responsible for various employment-related taxes. Some taxes are paid by employers, some are paid by the employees, and there’s one that is paid by both.

Let’s take a look at each more closely.

Federal Income Tax Withholding

Income tax withholding from employees’ paychecks is designed to cover what they owe in federal income tax for the year. Employees are responsible for all federal income tax that they owe, while employers are required to withhold income tax from their employees’ paycheck. Each new employee should complete a W-4 form, which will dictate how much federal income tax is withheld.

Federal FICA Tax

FICA is an abbreviation for the Federal Insurance Contributions Act. It is made up of Social Security and Medicare taxes.

Employees AND employers must pay half of the FICA tax burden. The current rates are:

- Social security = 12.4% of compensation (the employer pays 6.2%, and the employee pays 6.2%). Social security is limited to an annual wage base limit ($142,800 in 2021)

- Medicare = 2.9% of compensation (1.45% paid by the employer and 1.45% paid by the employee).

When an employee’s compensation from an employer exceeds $200,000 in the year, the employer must withhold an additional amount for the extra Medicare tax.

Whether the employee owes that tax depends on how they file their taxes. If they owe the tax, the amount is 0.9% of their earned income over the threshold:

- $250,000 for joint filers

- $200,000 for singles

- $125,000 for married persons filing separately

Note that regardless of whether the employee will owe the tax, employers must withhold it from their paycheck if the employee’s compensation is over $200,000. Additional Medicare tax is paid solely by the employee. The employer merely has the responsibility of withholding it.

FUTA Tax

Unless an organization is exempt (e.g., a charitable organization), it must pay into federal and state unemployment insurance.

Federal unemployment contributions are governed by the Federal Unemployment Tax Act (FUTA). An employee’s first $7,000 of taxable earnings is subject to FUTA tax. FUTA does not apply to the employee’s wages beyond that amount.

The standard FUTA tax rate is 6%, so the maximum contribution per employee that a company would have to make is $420. Employers can also claim a tax credit of up to 5.4% with a max of $378. As long as the business’s unemployment taxes are paid in full (and on time), they should be able to claim the full credit amount.

Self-Employment Tax

Typically, self-employment tax consists of the Social Security and Medicare taxes owed by individuals who work for themselves.

The self-employment tax rate, which is calculated using Schedule SE (Form 1040 or 1040-SR), totals 15.3%:

- 4% for Social Security (aid for the elderly, survivors, and disability insurance)

- 9% for Medicare (hospital insurance)

An individual must have a Social Security number (SSN) or an individual taxpayer identification number (ITIN) to pay self-employment taxes, which must be filed in estimated quarterly payments.

State Income Tax Withholding (SIT)

SIT is a required tax applied to an employee’s wages. Small business owners are responsible for deducting SIT from an employee’s gross wages and submitting the tax to the state’s tax agency.

All states, except for those listed below, require SIT withholdings:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

State income tax is withheld from each paycheck, and it is calculated using the employee’s pay. SIT rates vary by state. Other variables affecting the amount withheld include the employee’s marital status, the employee’s state withholding allowance amount, and, if applicable, any additional withholding amounts dictated by the employee.

When a new employee is hired, the individual must complete a W-4 form for the state. That form documents the key data points for employers to begin withholding the appropriate state income tax from the employee’s paycheck.

Once a small business registers for state income tax and has a completed W-4 form from the employee, the company can begin running payroll and withholding the tax from the employee’s paycheck.

State Unemployment Insurance Tax (SUI)

If a business hires employees, it must pay SUI taxes on their wages.

The SUI program offers short-term unemployment benefits to eligible workers who are unemployed because they have lost or left their jobs. The individual state’s laws determine SUI eligibility and benefits.

SUI rates vary by state. Also, they might be scaled based on the number of unemployment claims associated with a business. So, the more claims a business files, the higher its SUI tax rate might could become.

Businesses should register for SUI before paying their first employee’s payroll.

How to Register and Pay Employment Taxes

Below, I’ve listed some general steps for establishing and maintaining a compliant payroll process.

1. Obtain an EIN

While all the states and many cities have their own employment registration requirements, the first step for most businesses is to register for an Employer Identification Number (EIN). An EIN (also called a Federal Tax ID number) is required for any company that hires employees. The IRS uses EINs to track business transactions and tax records.

Businesses formed as corporations, limited liability companies, or partnerships are required by law to have one even if they don’t have employees. The IRS also lists some other situations when an EIN is necessary.

CorpNet can apply for an EIN on a business’s behalf, or business owners can fill out the IRS form online at irs.gov.

Once a business owner obtains an EIN, they will use that number throughout their company’s life on business documents, service agreements, bank accounts, and more.

2. Register With EFTPS

EFTPS (Electronic Federal Tax Payment System) is the free portal that lets business owners pay federal payroll taxes online or by phone. It’s a very fast and convenient way to get payroll-related money to the IRS. Obtaining an EIN automatically pre-enrolls a business to use the EFTP. Then the business owner has a few steps to take to activate their account at EFTPS.gov:

- Receive their PIN by mail.

- Call 800-555-3453 and enter their bank account information and phone number.

- Record their confirmation number.

- Set up a password for EFTPS.gov.

3. Pay Payroll Taxes

Generally, the business must deposit federal income tax withheld, and both the employer’s and employees’ Social Security and Medicare taxes. There are two possible deposit schedules that a business might have to use: monthly and semi-weekly. Before each calendar year, the company must determine which of the two deposit schedules they must use.

Deposits for FUTA tax are required for the quarter within which the tax due exceeds $500. The tax must be deposited by the end of the month following the end of the quarter.

All federal tax deposits must be made via electronic funds transfer via EFTPS.

4. Keep Accurate Payroll Tax Records

Accurate and up-to-date recordkeeping is essential! Businesses should keep all records of employment taxes for at least four years after filing the 4th quarter for the year. The records should be kept in a safe place and be available for IRS review.

Examples of Critical Payroll Tax Records

- Employer identification number

- Amounts and dates of all wage, annuity, and pension payments

- Amounts of tips reported.

- The fair market value of in-kind wages paid

- Names, addresses, social security numbers, and occupations of employees and recipients

- Copies of employees’ W-2 forms that were returned to the employer as undeliverable

- Employees’ dates of employment

- Periods for which employees and recipients were paid while absent due to sickness or injury and the amount and weekly rate of payments the business or third-party payers made to them

- Copies of employees’ and recipients’ income tax withholding certificates (Forms W-4, W-4P, W-4S, and W-4V)

- Dates and amounts of tax deposits the business made

- Copies of returns filed

- Records of allocated tips

- Records of fringe benefits provided, including substantiation

5. Avoid Mistakes and Payroll Tax Penalties

No business owner wants the hassle, expense, and potential legal issues that arise from not handling payroll taxes correctly.

Employers have the responsibility to file employment-related tax returns and deposits by their deadlines. Failure to make a timely deposit may result in a penalty of up to 15% of the taxes due.

And the responsible staff in the company who fail to deposit the amounts withheld from employees’ paychecks may be subject to a 100% personal liability. That means if their personal assets (home, car, bank accounts, etc.) could be at risk of being used to settle fines or legal disputes. A recovery penalty of that sort is triggered when a person with the authority to make payment decisions willfully fails to deposit the taxes. Shareholders or partners can be held personally liable should the partnership or corporation fail to pay payroll taxes. Both IRS Code section 6672 and California Unemployment Insurance Code section 1735 state that an individual (who is required to collect, account for, and remit payroll taxes) can be held personally liable for the payroll tax due which can include interest and penalties.

6. Understand Home vs. Out-of-State Tax Requirements

Let’s say a company has employees living in different states from where the business is located (all the more possible with so many remote workers getting hired); what happens then?

Answer: The employer must withhold and deposit federal taxes and withhold state income taxes in the state where the employee lives.

Employing workers in other states requires the business to register with that state’s tax agency, acquire a state income tax withholding number, get an unemployment insurance number, and withhold income taxes.

The company must also register with the state’s Department of Labor and follow the state’s laws for employees.

For example:

- Minimum wage

- Employer

- State disability insurance

- Worker’s compensation

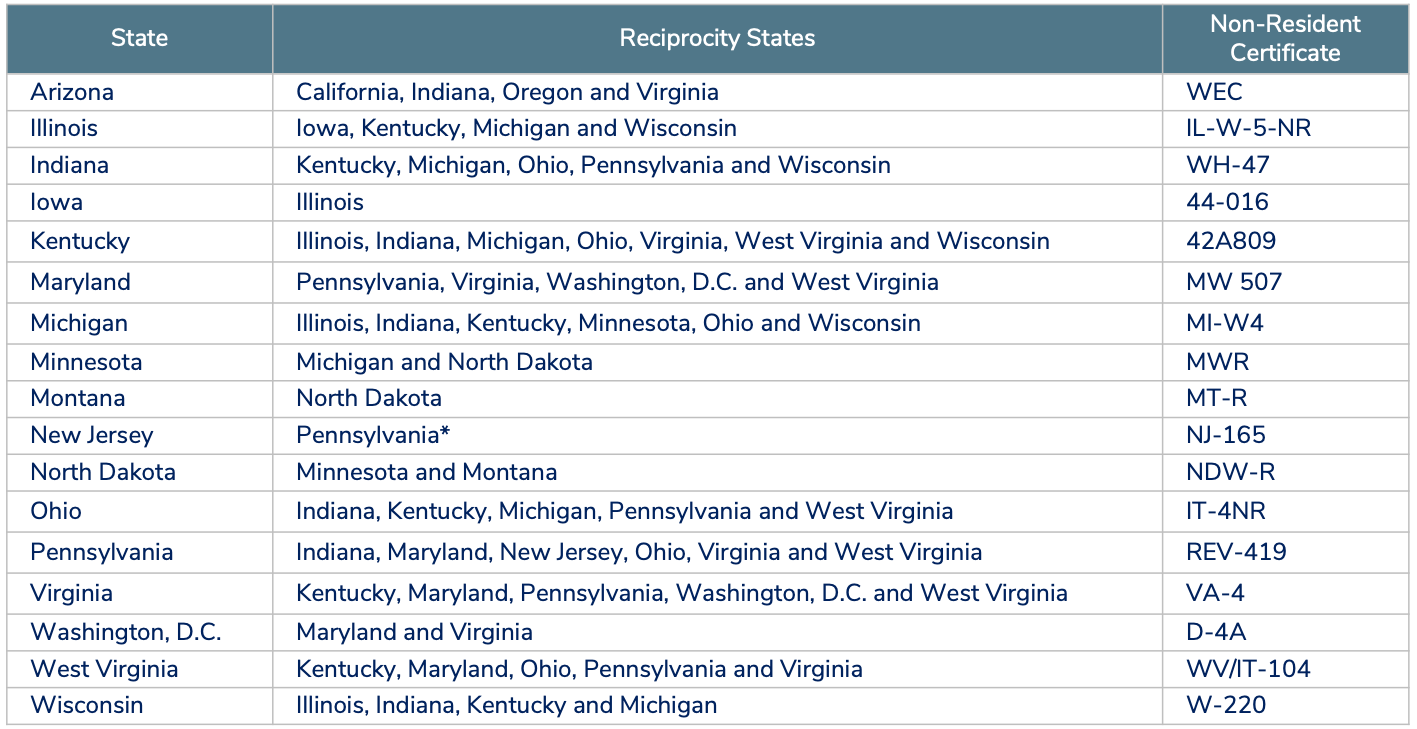

Note that some states have reciprocal agreements between them that allow employees that work in one state but live in another only to pay income taxes to their state of residency. If reciprocity exists between the two states, employees will need to complete and deliver a non-residency certificate to the employer to have residency state tax withheld instead of the work state tax.

While reciprocity is determined by an employee’s home address and pertains to their income tax withholding, unemployment liability is typically determined by an employee’s work address.

7. Know the Difference Between Contractors and Employees

Independent contractors are not employees, so their compensation methods and taxes are handled differently than regular full-time employees. That’s why employers must review the status of each worker to ensure that individuals working as independent contractors are properly classified as such.

Employers are not responsible for any employment taxes on payments made to independent contractors. Contract workers pay self-employment tax on their net earnings from self-employment, which is the equivalent of both the employee and employer shares of FICA added together.

When total payments made to an independent contractor are $600 or more in the year, the business must file an annual information return to report the payments to the worker and the IRS.

8. Consider Ways to Control Costs

Because a business doesn’t have to pay or match payroll taxes for independent contractors, it may save a company money to work with them rather than hire employees. A word of caution, though: Be careful to stick to the guidelines established for independent contractor status, or the IRS and the states’ tax boards could come after you for back payment of employer taxes.

Another way to potentially reduce costs is to elect S Corporation status. S Corps are structured as a pass-through business entity, which means profits and losses are passed through to the company’s owners. S Corp owners are also considered employees of their company, so their taxable salaries can be lowered, and there are fewer payroll taxes to be paid.

Tips for Making Payroll Processing Easier

As you can imagine, payroll can potentially take up a lot of a business owner’s time! Fortunately, there are ways to make the process simpler and less time-consuming.

1. Use Automated Payroll Software

One way to simplify payroll activities is to use automated payroll software designed for onboarding employees online and paying workers via direct deposit instead of by check.

Some software services automatically calculate state and federal taxes while also handling tax filings and payments.

Two quality payroll automation providers to consider are Gusto™ and Patriot™.

2. Outsource Payroll Processing

Another way to eliminate the time and work involved in managing employee payroll is to outsource the responsibilities to a PEO (Professional Employer Organization).

A PEO is an all-inclusive outsourcing option for handling HR tasks and employer liabilities, such as payroll and benefits. A PEO provides access to a wide range of benefits options, often at better rates, than what a small or medium-sized business could access on its own.

A company can effectively and efficiently mitigate a substantial portion of the risk and responsibility associated with having employees through a co-employment relationship with a PEO.

Payroll Tasks Handled by PEOs

- Payroll processing

- Payments to employees

- Payroll record keeping and compliance

- Online pay stubs and W-2s

- Payroll management reports

- Garnishment and deduction administration

- PTO (paid time off) accruals

Breaking Down Sales & Use Tax

Sales Tax

Sales tax is a transactional, consumer-based tax on the sale, transfer, or exchange of a product or service that is taxable. It is often referred to as a retail tax because it is generally added to the sales price of the product or service and collected at the time of purchase.

Sales tax is considered a pass-through tax. The business owner doesn’t have to pay the sales tax but instead serves as a conduit to collect the tax from the consumer and transfers it to the government.

Most states and nearly 14,000 local jurisdictions (counties, municipalities, and other local government bodies) impose a sales tax. Forty-five states and the District of Columbia collect some form of sales taxes. The five states that do not collect sales tax include Alaska, Delaware, Montana, New Hampshire, and Oregon.

Use Tax

Use tax is a tax on the storage, use, or consumption of a taxable product or service on which no sales tax has been paid. Generally, it is collected when the purchase is made outside the taxing jurisdiction. Use tax is broken down into two groups:

- Consumer use tax

- Seller use tax (also referred to as retailer use tax, vendor use tax, or merchant use tax)

Sales Tax Nexus

When a business has a “nexus” in a state, it implies the company has a connection to the state in some way. Sales tax nexus is the link between the seller and state that requires the seller to register, collect, and remit sales tax in the state.

When is a business considered to have nexus in a state? That’s a great question! Rules are constantly changing for determining nexus, and there is no specific universal definition of nexus across the 50 U.S. states.

Generally, nexus is established when:

- A business has a physical presence, such as an office, store, or warehouse, in the state.

- A business doesn’t have a physical presence but conducts a certain level of economic activity in the state (Most states have thresholds that determine a company has sales tax nexus if it has more than 200 sales transactions or $100,000 in sales within the state annually.)

Remote Sellers and Nexus

Remote seller nexus comes in various flavors. A state may address one or more types in its laws to require businesses that meet the criteria to register, collect, and remit sales tax.

- Click-Through Nexus – An out-of-state business contracts with an in-state individual or entity to refer (either directly or indirectly) potential customers to the out-of-state business through a web link. The referring individual or entity receives a commission or other compensation when a sale is made.

- Affiliate Nexus – An out-of-state business’s employee, agent, or person otherwise affiliated with the out-of-state company has a physical presence in the state.

- Marketplace Nexus – An online marketplace has its e-commerce infrastructure, customer service center, marketing operations, and payment processing services in the state. In this scenario, the marketplace operator has to obtain a seller’s permit and collect and remit sales tax rather than the individual sellers that use the platform to sell products in that state.

Sales Tax Nexus and Foreign Qualification

Limited liability companies (LLCs) and corporations (like a C corporation or S corporation) are considered “domestic” only in their state of formation. Therefore, those entities must foreign qualify in other states in which they wish to conduct business.

Some states require foreign qualification before businesses may apply for a sales permit or sales tax registration. Once foreign qualified, businesses also need to appoint a registered agent to accept their company’s service of process. Assigning an authorized registered agent is necessary to keep a business legally compliant and maintain good standing in the state(s) in which it operates.

When Nexus No Longer Applies

When a company no longer has nexus in a state and will no longer be collecting, reporting, and paying sales tax to the state or local tax authorities, there are some steps it must take.

- File a final sales tax return.

- Pay all sales tax collected to the state or local jurisdiction.

- Cancel the business’s sales tax permits.

- Maintain its sales tax records for future reference.

How to Manage the Sales Tax Process

1. Register for a Sales Tax Permit

Registering for sales and use tax is a requirement for both for-profit businesses and nonprofit organizations. Local governments will penalize companies that fail to comply with the proper collection, reporting, and payment of sales and use tax.

In areas where sales and use tax apply, a seller must obtain a Sales Tax ID Number, seller’s permit, or a sales tax permit. A seller’s permit application is submitted to the state’s department of revenue or treasury. The request can only be made after a business has formally registered with the state and obtained an EIN from the IRS.

Sales tax rates vary by state. In some states (California and Georgia, for example), sales tax may also be set by county, city, or zip code. To complicate matters further, these rates may change every quarter. Because of these variables, it’s essential for business owners to research the rates in each state where their companies have nexus. A CPA or sales tax automation service can help ensure a business collects and pays the correct rates.

2. Collect Sales Tax From Customers

Sellers (businesses that sell goods) must calculate and collect sales tax at the time of purchase. They must then hold that sales tax until it’s time to file a return and remit it to the proper tax authorities. Businesses may need to file sales tax forms monthly, quarterly, or annually depending on the state or local tax authorities’ rules and the amount of sales tax the business collects.

It’s illegal for businesses not to collect tax, report, and remit sales tax to local governments. So even though it may be inconvenient for companies, it’s critical to do so correctly! Businesses that fail to remit the proper sales tax may face criminal charges in addition to financial penalties and interest charges.

3. Complete and File Sales Tax Returns

Most states use electronic filing for sales tax returns. Business owners typically log onto the state’s department of revenue (or treasury) website and input the required data into a form. Some states have their system set up to allow businesses to import their data.

The due date for electronically submitted returns is usually one day earlier than paper filings. Businesses must make their sales and use tax payments on the same date that they file their return. Many states accept electronic payment — in fact, some require it.

Because the process for filing returns and making payments varies from state to state, I encourage business owners to stay on top of the requirements for any state where they must collect, file, and pay tax.

Helpful Tip: Automate Sales Tax Processing

Business owners can alleviate some of the sales tax headaches by using software that automates the process. Automated software services offered by companies such as Avalara®, TaxJar®, and Vertex will calculate the amount of sales tax to collect, create sales tax reports, and file the reports with tax authorities. Services like those can be especially beneficial to businesses with nexus in many states or those in a state that charges sales tax at the county and city level.

CorpNet Tax Services and Resources

CorpNet, with our years of business formation and compliance filings experience, is here to help you with your payroll registration and sales tax registration needs in all 50 states.

- State Withholding registration

- State Unemployment Insurance registration (SUI)

- Sales Income Tax registration (SIT)

Ready to streamline your payroll tax and sales tax registrations? Contact us today to save time and gain the peace of mind that your critical filings are in capable hands!

Additionally, we offer our CorpNet Partner Program to accounting, bookkeeping, and legal professionals who would like to provide those services and our full range of formation and compliance filing services to their clients.