The SBA’s Paycheck Protection Program is an amazing opportunity for small businesses. It provides a 100% forgivable loan to cover payroll, rent, and utilities. The United States government has moved swiftly to get this program funded and operational. And in some cases, a little too quick for the average business owner to keep up with.

Small business is the core of CorpNet and our service offering. We’d like to make sure we do everything we can to help business owners obtain PPP loan funds. To do this, we need to make sure you have everything you need to get you Paycheck Protection Program application submitted and approved.

Let’s walk through the documents and information you’ll need to get your PPP application submitted and ready for SBA approval.

If you’re applying for a Paycheck Protection Program loan, you’ll need to have a number of documents ready to share with your bank or of loan broker. Each bank will have its own set of qualification standards and document requirements.

I’m going to walk you through the information we use to submit loan applications for our clients.

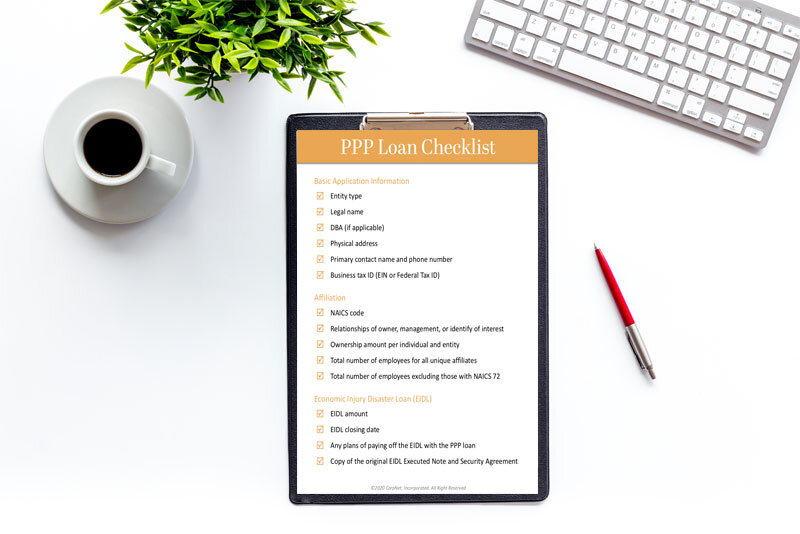

Due Diligence Checklist for PPP Loan Applications

The authorized lender will be required to submit a signed SBA Form 2483. While the small business owner doesn’t have to complete and submit this directly, it is a good idea to review the form because these questions will be asked by your lender.

Data Points for the SBA Form 2483

In preparing this form and supplemental information, the following items comprise a list of what will be required. Again, this list will vary by lender. This list is what CorpNet uses, as a loan broker, to submit PPP loan applications.

1. Basic Application Information

- Entity type – Sole Proprietor, Partnership, C-Corp, S-Corp, LLC, Independent Contractor, Self-Employed Individual, 501C3, 501C19, or Tribal Business

- Legal name

- DBA (Doing Business As)

- Physical address

- Primary contact name and phone number

- Business tax ID (EIN or Federal Tax ID)

2. Affiliation

This information pertains directly to questions on SBA Form 2483 that requests information on the applicant’s ownership in other businesses. If ownership is applicable to multiple businesses, the following data will be required:

- NAICS code

- Affiliate relationships of owner, management or identify of interest (if they exist)

- Ownership amount per individual and entity

- Total number of employees for all unique affiliates

- Total number of employees for all unique affiliates excluding those with NAICS 72

3. Economic Injury Disaster Loan (EIDL)

If the business has received an SBA Economic Injury Disaster Loan between January 31, 2020 and April 3, 2020, the following data will be required:

- EIDL amount

- EIDL closing date

- Any plans of paying off the EIDL with the PPP loan

- Copy of the original EIDL Executed Note and Security Agreement

4. Ownership Certificate

This data will be needed if multiple owners exist for the business. If this is applicable, the following data points will be required:

- Company name

- Name of signing officer

- Name of applicant

- Business NAICS code

- Information for each owner to include:

- Name

- Title

- Ownership percentage

- Date of birth

- Address

- Social security number or employer identification number (EIN)

5. 2019 Payroll Information

Because payroll is the core of this forgivable loan, all applicants will need to provide payroll information that includes:

- Total annual payroll amount

- A list of employees with compensation in excess of $100,000 that includes:

- Employee name

- 2019 gross compensation

- Total employee compensation to non-US residents

- Cash tips (or equivalents) paid outside of the payroll system

- Vacation, parental, family, medical or sick leave paid outside of the payroll system

- Employer health insurance contributions

- Employer retirement benefits contributions

- State and local income tax assessed

6. Additional Information

This next section will wrap up the information gathering for qualifications and it includes:

- Business legal name

- NAICS code

- Number of jobs created

- Number of jobs retained

- Prior SBA loans

- Franchise activity

- US citizen ownership

- Veteran ownership

- Use of proceeds in dollar amounts for:

- Payroll costs

- Utilities

- Mortgage interest payments

- Rent

- Refinance eligible EIDL

7. Wiring Instructions

And finally, we’ve reached the part where we provide information on where to send our forgivable loan. This data will include:

- Name

- Phone number

- Bank name

- Bank account type

- Bank address

- Routing number

- Account number

- Name listed on the account

- Account owners name

- Address listed on the account

Supporting Documentation

The below documents will be required to help support the above provided details.

- Applicant Formation Documents – Articles of Organization or Certificate of Incorporation

- Applicant Governance Agreement – Operating Agreement or Bylaws

- IRS Form SS4 – EIN Verification

- Certificate of Good Standing

- Copy of Voided Check

- Franchise Agreement (If applicable)

- EIDL Original Executed Note and Security Agreement (If Use of Proceeds include refinance of EIDL)

- Driver’s Licenses Copy for Front and Back – For all owners with greater than 20% ownership

Payroll Documentation

The below documents will be required to help support the payroll calculations provided.

- 2019 IRS Form 940

- 2019 Payroll Report by Employee (W-2 Summary)

- Payroll Report by Employee (W-2 Summary) – If the business did not start operations until after June 30, 2019, provide January 1, 2020 – February 29, 2020.

- Proof of 2019 Payroll Costs Not Included in 2019 Payroll Report – Health Insurance, Retirement, etc.

- Proof of Payroll and Payroll Taxes Paid on or Through 2/15/2020

- February 2020 Business Bank Account Statement – Show February payroll payment.

Sole Proprietors and Self-Employed

Sole proprietors, self-employed, and 1099 contractors will require variations to the above requirements

- Independent Contractors – 2019 IRS Form 1099-MISC for any independent contractors paid and not to exceed $100,000 for the year.

- Sole Proprietorship – 2019 IRS Form 1040-C

While the above data points and documention can feel like a lot of information, it is required for the bank to validate the application and request for funding.

Your payroll processor may have many of these calculations and forms waiting for you online. Major providers like Paychex have documents ready to go so you can easily access the calculations and forms needed for your applications.

Getting Help

There are several ways to apply for the various government programs. You can complete the SBA form yourself; find out if your bank offers the SBA loans; work with your accountant; or work with an SBA loan packager.