The Launch Blog: Expert Advice from the CorpNet Team

What Is an Executor of an LLC?

An LLC executor is a designated person or business entity that an LLC’s members appoint to handle certain legal and tax-related aspects of their business at various stages of its existence. An executor might assist LLC members through the business formation process, helping to complete and file the required paperwork with the Secretary of State office and other agencies. LLC members might also rely on the executor to prepare and file business compliance filings necessary to keep the LLC In good standing with the state. After a member dies or LLC members decide to close their company, an...

Why Small Businesses Fail

Owning a small business is the American dream. But sometimes, despite all the hard work, that dream turns into a nightmare and businesses don’t make it. Understanding why small businesses fail can be as crucial as knowing the secrets of those that succeed. Being aware of the signs of business failure can help you spot when you need to take immediate action to keep your business going. Here’s what to avoid. 1. Lack of Experience The challenge: Many new entrepreneurs have no prior business experience or are unfamiliar with the industry of their startup. They may not understand the basics of...

Back to School, Back to Your Business

With autumn approaching, many entrepreneurs and other professionals with school-age children face a double dose of challenges. Back to school brings break-neck fall schedules packed with events and extracurricular activities that demand parents’ time. And as kids adjust to the new norm, adults must play catch up professionally as they take stock of the business responsibilities they may have put on the back burner during the summer. Below are some tips to help you and your family survive and thrive while working through the transition. Back to Business 1. Time to Focus If you’re an...

What Is a Certificate of Formation?

If you’re considering starting a business as a Limited Liability Company (LLC), you’ll want to become familiar with the term “Certificate of Formation.” Sometimes called Articles of Organization or Certificate of Organization, a Certificate of Formation is the legal document LLC owners (members) must file with the state to form their business entity. By filing a Certificate of Formation, LLC members provide the state with the information it needs for deciding to approve or disapprove a company as a registered entity. Each state has its own requirements for forming an LLC, and the...

Should I Be My Own Registered Agent?

The owner of a Limited Liability Company (LLC) or Corporation might consider being their own registered agent since it eliminates the cost of contracting another party to accept service of process and other official notifications on the business’s behalf. However, while legally you may be allowed to be your own registered agent, it’s likely not the best option. Why? Let’s talk about a registered agent’s responsibilities and the valid reasons for entrusting those duties to a commercial registered agent rather than taking them on yourself. What Does a Registered Agent Do? A registered agent...

Registered Agent Options for Non-Citizens

If you’re a foreign entrepreneur wishing to start a business in the United States, I expect you may have many questions about the process. Non-citizens can own a U.S-based Limited Liability Company (LLC) or C Corporation, and like U.S. residents, non-resident business owners must comply with federal, state, and local rules and regulations to legally form and operate a business entity. Among those requirements is designating a registered agent in the state where the foreign owner registers their company and other states where it will conduct business. What Does a Registered Agent Do? A...

What is a Corporate Resolution?

A corporate resolution is a formal record of a corporation's board of directors' decisions and actions on behalf of the company. States require incorporated companies to use corporate resolutions for recording major business decisions. The company's board of directors must vote to approve resolutions either during board meetings or in writing.

A Guide for Starting a Business in Michigan

If you’ve been thinking about starting a business in Michigan, you're in good company. With plentiful resources, incentives, and loans, Michigan is home to 902,000 small businesses that represent 48.3 % of the state's workers. Michigan offers one of the best pro-business environments in the country and provides businesses with the support they need for expansion and growth. Bloomberg ranks Michigan first in state economies with a population over 2 million and CNBC ranks the state in the top ten for the overall business. We'd like to help you get started with your Michigan small business,...

What is a BOC-3 Process Agent?

The BOC-3 federal filing designates process agents to accept legal documents on behalf of transportation companies. The process agent company must list the process agents in all other states where the company conducts business.

Time is Running Out on $1 LLC and DBA Filing in Colorado

Since July 1, 2022, the filing fees required to be paid for the registration of new businesses within Colorado have been reduced to $1. This savings includes the formation of a Limited Liability Company (LLC) and initial tradename registrations (DBAs). Colorado Business Fee Relief Act from July 1, 2022 provides for the waiver of such fees until June 30, 2023. Now is the time to take advantage of these savings! The waiver will end at 12:00 PST on June 30, 2023. That just leaves a few hours left to take advantage of this business formation discount.Grab Your SavingsHow Does This Affect...

Time is Running Out on California Waiving Business Formation Filing Fees

Since July 1, 2022, the filing fees required to be paid for the registration of new businesses with the California Secretary of State have been waived. This includes Corporations, Limited Liability Companies (LLCs), and Limited Partnerships (LPs). California’s Budget Act of 2022 provides for the waiver of such fees until June 30, 2023. Now is the time to take advantage of these savings! The waiver will end at 12:00 PST on June 30, 2023. That just leaves a few hours left to take advantage of this business formation discount.Grab Your Saving on Business Formations Click on any link below...

How to Add a DBA to an LLC

Some companies, such as Limited Liability Companies (LLC), choose to do business under a different name than the one they have registered in their formation documents. Like other businesses, before an LLC may use an alternate name in its contracts, advertising, and customer interactions, it must complete a Doing Business As (DBA) filing to register the name. Fortunately, it’s not difficult to add a DBA to an LLC. Anatomy of a Doing Business As (DBA) A DBA legally allows an LLC to use a different name to conduct business. Other terms that states use when referring to a DBA include...

What is an LLC Statement of Information?

No matter which state your Limited Liability Company (LLC) is located in, you will need to file documentation with the Secretary of State to establish your company and keep it legally compliant. A Statement of Information is one of the standard reporting requirements that many LLCs across the United States must adhere to. A state may require a Statement of Information as an "Initial Report," due shortly after registering a business. Many states will also mandate LLCs to submit a Statement of Information (sometimes called an "Annual Report") each year, every other year, or on some...

What are Articles of Organization?

Have you decided to operate your business as a Limited Liability Company (LLC)? If you answered yes, you must comply with your state's requirements for registering your company. Those responsibilities include filing an Articles of Organization (sometimes called a Certificate of Organization or Certificate of Formation) with the state government. The Articles of Organization is a legal document containing important information about the business. The Secretary of State's office must approve the document for the LLC to be recognized as a legal entity. Why Articles of Organization Are...

Can an H-1B Visa Holder Start an LLC?

People interpret the American dream differently. For many foreigners, it likely represents an opportunity for prosperity and success. Coming to the United States and starting a business is often the start of that prosperity. The United States government allows nonimmigrant alien workers with specialized knowledge to come to America on an H-1B work visa if they’ve been offered a job. But what if the H-1B visa holder wants to start their own company in the United States? Is this allowed? And if so, how is it done? In today's post, I cover how starting a Limited Liability Company (LLC) could...

What Is LLC Service of Process?

When someone sues an LLC, the procedure of delivering the legal paperwork that initiates the lawsuit and allows it to proceed is referred to as service of process. Service of process notifies the LLC of the lawsuit, and it establishes that the court hearing the lawsuit has jurisdiction to do so. The U.S. Constitution’s Due Process clauses in the Fifth and Fourteenth Amendments prevent courts from exercising jurisdiction over a defendant unless proper notice is given, which makes service of process immensely important. Service of process commonly involves the following legal documents:...

10 Ways to Promote Your New Business

Excited to start your new business in the coming year? Whether you’re forming your company as a sole proprietorship or a Limited Liability Company (LLC), promoting a new business takes strategizing and fresh ideas. Otherwise, it’s challenging to get your new business noticed. Here are 10 ways to promote a new small business in 2021. Business Name Not to be overdramatic, but your business’s name could mean the difference between failure and success. You want to pick a name that not only tells consumers (whether B2B or B2C) what your company does but also targets the right customers and is...

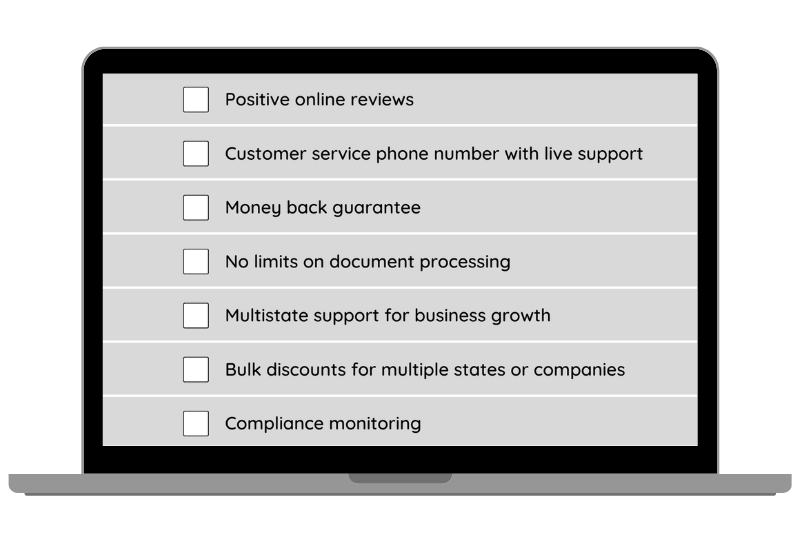

How to Find and Compare Registered Agent Service Providers

As a serial entrepreneur with a heart for helping other entrepreneurs, it pains me to see business owners misled by registered agent services providers who offer bargain basement prices. These low-priced registered agents focus on offering the cheapest price possible and they do this by limiting services and hiding incremental fees. They lack customer support, have limited service capabilities, and have inadequate expertise to address customer questions and issues. And at the end of the day, this low-priced service usually comes at the buyer’s expense. Unfortunately, many new small...

What Is a Subsidiary?

The word “subsidiary” gets tossed about a lot in the world of business. But what does it really mean? A subsidiary is a company owned or controlled by another business entity (known as a parent company, holding company, or umbrella company). A parent company might own all of a subsidiary or achieve control by having a majority ownership stake (i.e., over 50%). Because the parent company has a controlling interest, it has a say over its subsidiary company’s governance. For example, the parent company will elect the subsidiary’s board of directors. Although a parent company may influence...

What Is the Difference Between Sales Tax and Sellers Use Tax?

Whether you sell products or services in one state or many states, it’s imperative to understand your business’s sales tax compliance requirements. To correctly register a business in a state and then file the proper sales tax, you need to know the difference between sales tax and sellers use tax and how nexus affects your obligations. Sales Tax Sales tax is a transaction tax paid by a consumer for a product or service and is a percentage of the sales price. Although not all states charge a sales tax, it is the seller’s responsibility to know which states do, to collect the sales tax, and...

What Comes After Incorporation? 12 Steps to Keep You On Track

Congratulations! You have officially registered your Limited Liability Company or Corporation with the state. But now what? What happens next? While forming an LLC or Corporation is a critical first step to operating a formal business entity, there's more work to do to keep it legitimate and in compliance. The tasks and filings vary depending on a company's growth objectives, type of business activities, and location. In this article, I talk about what comes after incorporation and I'll share some of the obligations that entrepreneurs must fulfill. However, keep in mind that your...

Articles of Incorporation vs. Articles of Organization

If you're thinking about starting a business, you’ll want to research which business entity type will be most advantageous to you. As you go through that process, you will discover that various documents and filings need to be submitted to the state to form a Limited Liability Company (LLC) or C Corporation. Articles of Incorporation and Articles of Organization are among them. Articles of Incorporation An Articles of Incorporation (sometimes called a Certificate of Incorporation) is a form that states require to set up a C Corporation. When a company's Articles of Incorporation are...

The What, Why, and How of Incorporating Out-of-State

A lot of entrepreneurs wonder what state should be used to incorporate a new business. Should it be their own state or maybe another state like Delaware or Nevada? There is no easy answer to that question, however, there are definite benefits for some businesses to incorporate in states other than where they conduct business. Let’s look at some examples of why you might incorporate out-of-state and then we'll review a few situations that will require you to register a foreign qualification. Why People Consider Incorporating Out-of-State Many people choose to incorporate their businesses...

How to Legally Start a Food Truck Business

According to IBISWorld, the food truck industry has 25,476 businesses in 2020. Growth in the industry from 2015 to 2020 averaged 8.7%. With the COVID-19 crisis a reality now, arguably, the food truck industry may be better suited than brick-and-mortar restaurants to navigate the challenges. With more people consuming take-out food and spending less time in sit-down establishments, food trucks may appeal to customers' desires for getting good food fast and with less person-to-person contact. In this article, I’ll share insight to get you headed down the right road on your entrepreneurial...

Seven Steps to Creating a Business Emergency Preparedness Checklist

It's an understatement to say the last few years have been tumultuous. Nearly every business has felt the pandemic's economic effects, and many have faced natural disasters such as hurricanes, tornadoes, draughts, and wildfires. With CorpNet's location in southern California, I relate first-hand to the challenges that entrepreneurs have faced. Our office has closed due to wildfires and COVID-19. Fortunately, we have a small business disaster recovery plan in place that has enabled us to continue our operations without sacrificing the quality of our customer service or our ability to meet...

Do You Need an LLC for a Hard Money Loan?

Do you need a register an LLC to obtain a hard money loan for your real estate investment? Let's explore the LLC and hard money loans so you can decide. What is a Limited Liability Company? A Limited Liability Company (LLC) is a formal business structure that is the simplest to form and maintain. Creating an LLC offers some of the same benefits as a corporation, without the costs and compliance complexity. Business owners who are looking for personal liability protection, tax flexibility, and management options may find that registering an LLC will be an ideal choice for their company....

Sole Proprietorship vs. Partnership

You have much to think about and many questions to answer when starting a business. One of the most fundamental considerations is what type of business structure is right for you. Often, new small businesses choose to operate as a sole proprietorship or general partnership. Would either be a good fit for you? As you compare the sole proprietorship vs. partnership you'll have lots of questions. In this article, I’ll share information about the similarities and differences between the two business structures and some thoughts about other business entity types to consider. This information...

How to Start an Amazon Business

If you've been intrigued by the flexibility and income potential of selling online, starting an Amazon business is probably at the top of your to-do list. There's no denying Amazon's reach and reputation, which is why so many Americans have a strong pull toward launching an Amazon store. If you're on the fence about jumping into the world of Amazon, these statistics will solidify your plan: Amazon receives over 2 billion visits per month Amazon sellers can reach customers in over 180 countries There are over 300 million active Amazon shoppers worldwide Customers complete 28% of their...

How to Legally Start a Nonprofit Business

There is nothing more fulfilling than directing time and energy toward helping others in need. If you're passionate about a cause, you may have wondered how to start a nonprofit business. Some aspects of starting a nonprofit organization are similar to starting a for-profit business, but nuances exist. Incorporating a nonprofit can be confusing and complicated. Let’s dive into what it means to be a nonprofit organization and explore some of the considerations and steps involved in becoming one. Please keep in mind that the information that I'm about to provide in this article is not...

What is a Holding Company?

Many business owners operate multiple businesses and there’s a good reason for that. Once you have one business and business structure in place, it’s much easier to get a new business off the ground than if you had to start from scratch each time. At some point in your entrepreneurial life, you may come upon an idea or opportunity too good to pass up. But you have no intention to stop operating your current business. So, the question becomes how should you structure the new business. Should it be a part of the original business, a DBA (Doing Business As), or a completely separate business...