The Launch Blog: Expert Advice from the CorpNet Team

The CorpNet Partner Program Opens a New Revenue Stream for Your Business— Without Adding Overhead

The CorpNet Partner Program gives professional services providers a way to increase revenue without adding overhead. Here’s how it works.

A Mid-Year Business Checklist to Get You Back on Track

Tax season is over (for most of us). So, what’s next for business owners and professional advisors with business clients? With so much disruption and distraction this year, you may have fallen behind keeping up with compliance for business licenses, permits, and identification numbers. Here’s a mid-year business checklist to get you back on track. Federal Tax ID Getting a Federal Tax ID number (or an Employer Identification Number—EIN) is optional if you’re a Sole Proprietorship, but if your business acts as a C Corporation, Limited Liability Company, or a Partnership, you and your...

16 Considerations When Choosing a Business Filings and Compliance Provider

Entrepreneurs cannot succeed in business completely on their own. Successful business owners will leverage their talent, expertise, and skills, while also being quick to delegate tasks and responsibilities to others with the knowledge and proficiencies they lack. For example, not very many business owners know all the ins and outs involved in preparing and submitting the paperwork involved in setting up a business entity and keeping it compliant. Rather than trudge through the process and hope for the best, it's wise for business owners to enlist the help of a business filings and...

How to Protect a Business Name

As an entrepreneur, my business name is my greatest asset. I have invested countless hours promoting my business. I have untold articles hoping people respond favorably when they hear the word "CorpNet." I have traveled across the United States, away from my husband and children, promoting my business name and its products and services. Thus, preventing others from using or "stealing" my brand name is of utmost importance to me. And, the quest to protect a business name should be important to you. Registering a Business Name Offers No Protection After speaking with several other...

Seven Tips for Optimizing LinkedIn for Accountants

With more than 849 million users, LinkedIn is a powerhouse of social media. While it doesn't command the 2.9 billion users of Facebook, it is the top location for connecting at a business-to-business level. The social network has established a solid niche for itself by focusing on workforce needs such as finding new business, searching for jobs, and building professional relationships. Plus, if you know the secrets to using it successfully, LinkedIn could be a major revenue generator for your accounting business. Here are seven tips for getting started with optimizing LinkedIn for...

Interview with CorpNet Co-Founder: Phil Akalp

CorpNet celebrated its third birthday on July 1, 2011! We thought you might like to go behind the scenes to learn more about Phil Akalp, one of the founders of the company.

CorpNet Listed on Inc.’s Power Partner Awards for 2023

CorpNet is proud to announce that it has made Inc.’s Power Partner list for 2023. CorpNet is one of 389 companies to make the list. The Inc Power Partner award recognizes B2B companies that provide exemplary products and services for their partners. The award focuses on actual client interviews that discuss criteria such as the value of services and the nominee's service quality in comparison to its competitors. For CorpNet, this award acknowledges the exemptional business filing and compliance services provided to partner companies like Soulence Tax & Wealth Advisors, K&K...

How to Start a Consulting Business

If you have a high level of proficiency, expertise, and experience in a field, you may have thought about how to start a consulting business. Starting a consulting business can be a wonderful career option for individuals who want to leverage their knowledge and skills while enjoying the flexibility and autonomy of self-employment. Even if you don't presently have experience doing the type of work you're interested in, you may be able to achieve your dream with hard work, education, training, and attention to complying with the professional and legal requirements. In today's post, we'll...

LLP vs. LLC

When you’re starting a small business that has more than one owner, you and your partner(s) may have concerns about your personal liability risks. If this is the case, it would be wise to compare LLP vs. LLC business structures. Limited liability partnerships (LLP) and limited liability companies (LLC) combine some aspects of general partnerships and corporations. As a hybrid business entity type, they each provide a level of liability peace of mind for their owners while preserving some of the simplicity of operating as a general partnership. Although they have some things in common,...

How Much Do Small Business Owners Really Make?

We all dream of having our own business, being the boss, and controlling our own destiny. I can assure you the dream is indeed possible. But will that dream, and future success be enough? How much do small business owners really make per year? And will it be enough to support them, their families, and their ideal lifestyle? There are multiple factors affecting an entrepreneur’s annual income. Some are within the owner’s control while others are not. Today, we will discuss how much a small business owner can expect to make per year. Experience and Expertise To me, the number one component...

How to Manage Payroll for Restaurants

Maintaining an exceptional staff reigns as one of the essential ingredients for a successful restaurant. With hiring that staff, comes payroll responsibilities and complying with all related federal, state, and local employment and tax laws. Payroll for restaurants is complex. It entails calculating work hours, wages, salaries, benefits, and wage garnishments; withholding and paying employment-related taxes; reporting and remitting withholdings to the appropriate agencies; and dealing with the nuances of handling tipped employees’ compensation and tax withholdings. The percentage of...

When’s the Best Time of Year to Form an LLC?

Have you been thinking of launching a new business or changing your existing Sole Proprietorship to a formal business entity type like a Limited Liability Company, S Corporation, or C Corporation? Are you concerned that you might not be selecting the best time of year to form the new business? There's never a bad time to register your business as a legal entity because doing so helps protect your personal assets and might offer some tax advantages, as well. But filing your paperwork to make it effective before the New Year has its perks! So if you are considering starting a new business,...

Is Your Business in Compliance? Seven Questions to Ask Yourself

Maintaining a C Corporation or Limited Liability Company (LLC) is an ongoing process that requires constant attention. Unfortunately, most small business owners don’t know what they don’t know and busy entrepreneurs often find it tough to carve out time to research what’s required, let alone follow through on it. Not maintaining compliance with all the rules and regulations might saddle you with fines and even expose your business to liability risks. I don't want that to happen to you and I’m sure you don’t either! Here’s a quick checklist of questions to ask yourself to assess your...

Business Closures, Dissolutions, and Withdrawals

It has been a rough few years for businesses across the country, but especially so for small businesses. From COVID-19 to inflation, companies of all sizes have had to close some or many of their locations. Whether you’ve had to close down entirely or shutter locations in other states, it’s crucial you legally close your business so there are no repercussions down the road. In many cases, this means you need to take action before we close out the 2023 calendar year. I want to help keep you and your business in compliance. If you've had to close part of all of your operations, here are...

Don’t Be Nervous About Your Annual Business Review!

It's already November and we are rapidly approaching year's end. This means the time has come for an annual business review. What is an annual business review? You might think this is the annual report C Corporations and Limited Liability Companies (LLC) must file each year with the state. In truth, that is one part of the annual review process, the annual compliance filings, however, there is more to consider when reviewing your business. The following are 10 areas of your business to review: the good, the bad, and the required to take your business into 2024 on solid ground. 1....

How to Start a Business in Wisconsin

If you're considering starting a new business in Wisconsin, there are a lot of reasons why this is a great option. Wisconsin offers a robust business ecosystem with a skilled workforce, business-friendly policies, and a central location in the U.S. It provides a high quality of life, support from local organizations, access to research and innovation, and proximity to major markets. The state’s industry clusters, access to capital, and economic development incentives make it an attractive choice for entrepreneurs. Start-up businesses are core to my heart and our services here at CorpNet....

A Guide to Small Business Taxes

No matter the type of business you operate, taxes are among the expenses you must anticipate and budget for. While not the most pleasant aspect of running a company, business taxes require an entrepreneur’s attention and follow-through because penalties exist for not reporting and paying them on time. Here’s a look at some federal, state, and local taxes small business owners should understand and prepare for. Federal Business Taxes Federal Income Tax Businesses must pay income tax on their taxable earnings. The income tax rate depends on how the business is structured. At the time of...

How to Appoint a Registered Agent

Appointing a registered agent for your business entity isn’t terribly difficult, but it does require a little effort on your part. Whether you’re starting a brand new business and need to designate a registered agent for the first time or you want to change your existing registered agent services provider, it’s important to do it right. Here are the five steps to guide you through the process. 1. Compare and Choose a Registered Agent While some states allow individuals or business owners to serve as registered agents, that’s often not the wisest path. States have minimum requirements for...

What Is an Agent for Service of Process?

An agent for service of process is an individual or business that accepts important legal and government notices on behalf of an LLC or Corporation. More commonly known as a registered agent, designating an agent for service of process is a requirement for LLCs, Corporations, and some other registered business entities. A state will require a registered business entity to have a registered agent if the business is located in (or is foreign-qualified to operate in) the state. If a Corporation or LLC is located in one state and conducts business in others, it must have a registered agent in...

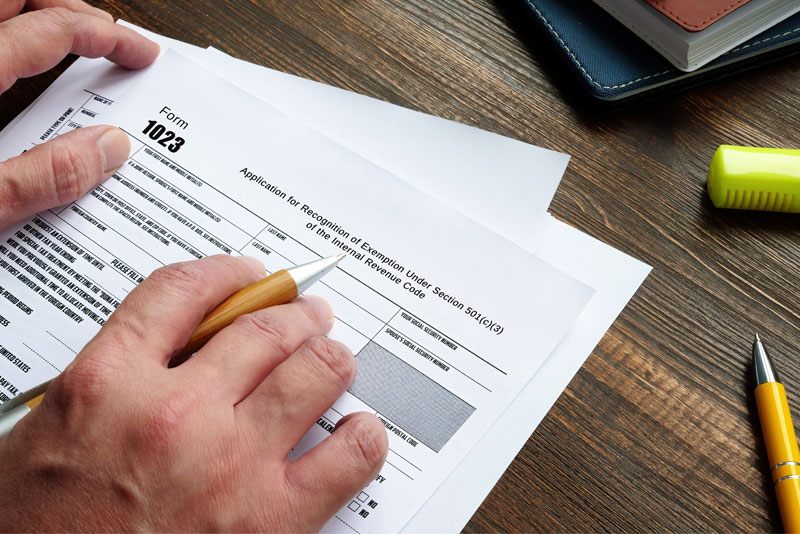

What Is Form 1023?

Filing formation paperwork with the state is just one step required to start a 501(c)(3) tax-exempt nonprofit organization. Federal income tax exempt status isn’t automatic. A nonprofit must file Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, with the IRS to request federal income tax exemption. The form is quite long and involved, so it can be helpful to talk with an accounting professional for guidance as you prepare to complete it. The obvious benefit of 501(c)(3) status is being exempt from paying federal income tax. Also,...

How to Start a Freelance Business

Starting a freelance business can put you on a path that leads to autonomy, creative freedom, and the opportunity to shape your professional destiny. Freelancing is not much different than building a small business, however, as a freelancer you work for yourself and you are considered self-employed. While your primary role is to work part-time for clients via projects or ongoing retainers, just like any other business, building a brand as a freelancer is also important. Of course, building a freelance business has additional challenges. It requires meticulous planning, strategic...

What Taxpayers Need to Know About the IRS’s Extended Tax Deadline

Due to the severe winter weather conditions that impacted much of California and parts of Alabama and Georgia, the tax deadline for 2022 individuals and businesses, the Internal Revenue Service (IRS) extended its tax deadlines to October 16, 2023. Some parts of Georgia were additionally affected by Hurricane Idalia—see below for updated tax filing information if you live in the impacted areas. In addition, October 16 is the final deadline for this year for those taxpayers who filed for regular tax extensions last April. That day is fast approaching, and with no additional extensions...

What Is a DUNS Number and How Do You Get One?

A Dun & Bradstreet (D&B) D-U-N-S® Number is a unique nine-digit number assigned to a company to help potential lenders, partners, and suppliers assess the business’s stability, creditworthiness, and other qualities. Having a DUNS Number can help a company build a business credit history and demonstrate its credibility. A company’s DUNS number identifies it as unique from any other company in the Dun & Bradstreet Data Universal Numbering System database. DUNS Numbers are assigned through D&B’s proprietary verification process for confirming a company’s information. D&B...

Can You Get a Startup Loan for Your Small Business?

Starting a small business is exciting, but that alone is not enough. Achieving your goals will often require a long list of needs with money being at the top of that list. While most startups are self-funded, many entrepreneurs want and need a small business loan. Obtaining a startup loan makes it easier to turn your business ideas into viable companies. They provide a solid financial foundation to build a business and make it easier to weather the initial challenges and uncertainties of a startup. Startup loans provide new small businesses with: Cash infusion - Having more available...

What Is FICA?

Business owners who hire employees must withhold, deposit, report, and pay Social Security and Medicare taxes per the Federal Insurance Contributions Act (FICA). FICA taxes are applied to all of an employee’s taxable compensation, which includes salary, wages, commissions, bonuses, and certain fringe benefits. Eventually, an employee’s pay remitted to FICA (and the monies paid by their employer) will benefit the employee in the future. Social Security tax provides financial benefits to retired individuals, disabled Americans, and survivors of deceased citizens. Medicare tax funds the...

Fall Tips To Help Your Business Have A Strong End-Of-Year Finish

Although most of the year has already passed and we’re now into the autumn season, don’t panic if your business has fallen a little bit behind on its goals. It’s not too late to make changes that can help lead to a strong finish in 2023. Whether you’ve just started your business or have been running yours for years, the key is to take action sooner rather than later—and to focus on efforts that will improve your bottom line now and into 2024. Nurture Customer Relationships If you’ve fallen out of touch with some customers, now’s the time to reconnect. Just be careful to do so with their...

How to Sell Your Business Idea to Investors

Whether you’re in the early stages of a startup or looking to scale your existing business, the one hurdle many small business owners face is obtaining funding. While entrepreneurs in some industries may have an easier time, typically, it is challenging to sell your business idea to investors. Convincing someone to invest in your business is not just about showing potential profitability. There’s a whole process involved. You have to sell your vision, team, and ability to execute. Here’s a step-by-step guide for small business owners interested in selling their business ideas to...

How Do I Maintain a Business?

After a business is up and running, it's critical to maintain it by fulfilling all of the required business compliance tasks on time. Of course, businesses grow and evolve over time, and therefore, the actions they must take to maintain a business entity also may change. Fortunately, CorpNet is here to help you learn how to manage your business effectively every step of the way. What are some of the business considerations entrepreneurs should keep in mind? Below, I’ve listed several situations where changes in a business will involve business compliance filings. 1. Hiring employees...

What is a Registered Office?

You'll likely encounter some unfamiliar terms when forming and managing your business. One phrase is a registered office, which refers to the physical address where a company receives service of process, which are legal documents and government notices that need immediate attention. Compliance can be confusing, so let's review what a registered office is and why you may need one. Common Law vs. Statutory Entities One of the first things you need to do when starting a new business is to decide on a business structure. There are two different types of business structures that would pertain...

Can an LLC Owner File for Unemployment?

Can an LLC owner file for unemployment? The quick answer is yes, but not in every situation. There are advantages to owning a Limited Liability Company (LLC), with tax flexibility, serving as one of the major benefits. How you elect to structure your LLC for tax purposes is what makes the difference in being able to file for unemployment. What is the Unemployment Insurance? Payroll taxes are incurred at the state and federal level. Employers must register for the appropriate tax accounts to hire employees, to process payroll, and to file returns. Unemployment Insurance Tax (UI) is a...