The Launch Blog: Expert Advice from the CorpNet Team

10 Legal Documents You Must Have to Start a Small Business

If starting a new business is on your 2022 New Year’s resolution list, we’re here to help you begin on the right (and legal) path. Here are 10 must-have legal documents you need to start a new business. 1. Business Plan Technically, a business plan is not a “legal” document, nor is it required to start a business, but developing a business plan before you attempt to secure financing, look for office space, or even pick a business name, is highly recommended. Creating your plan at the beginning forces you to assess your goals and resources, strategize a road map for success, and determine...

Business Name Restrictions: What to Know Before Registering Your Business

One of the most exciting initial tasks to tackle when starting a business is brainstorming names for your company. It’s also one of the most critical to-dos; your company’s name will be the foundation of your brand, so you need to consider it carefully. As you embark upon the process of deciding what you will call your company, there are some business name restrictions you should be aware of. Every state has its own set of rules regarding what is and is not allowed in business names. Most states will not allow a business to: Include business entity identifiers such as “Incorporated,”...

How to Start a Small Business on Etsy

Etsy has given artists, crafters, and collectors a highly visible online marketplace for selling their own-made arts and crafts, vintage items, and crafting supplies. Are you a talented, hands-on individual with a vision of offering your creations to customers across the United States or even beyond? Then you have probably wondered how to start a small business on Etsy. I can understand why! Here are just a few data points that I find exciting: The number of active buyers on Etsy has increased steadily over the years, going from 9.3 million in 2012 to over 46.3 million in 2019. The number...

How to Legally Start a Marijuana Business in California

With the legalization of marijuana for adult recreational use in California, it’s an exciting time for the state’s business community. The law brings many opportunities for entrepreneurs interested in producing and selling cannabis and cannabis products. CorpNet is working with aspiring cannabis business owners in California. We’ve found many are struggling to “weed” through what they need to do to legitimately start their companies. And I’m not surprised. There’s a lot of information out there, and much of it is confusing! Are you facing the same challenge in starting a marijuana...

How to Start a Restaurant Business

Are you thinking about how to start a restaurant business? Without a doubt, it's an industry that contributes immensely to our economy. According to statistics from the National Restaurant Association, there are over one million restaurant locations in the United States, and they collectively employ 15.6 million people. What I think is especially encouraging about the restaurant industry is that it has a track record of opening the door to entrepreneurship to people with humble beginnings who are willing to work hard and learn. Many people who start a restaurant begin by working in the...

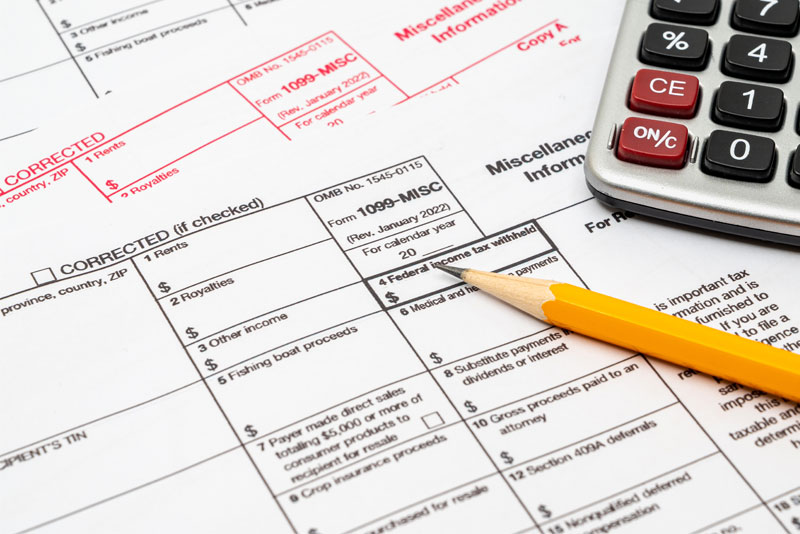

Does an LLC Get a 1099?

Many freelance professionals and independent contractors operate as Limited Liability Companies (LLCs). The requirements for when a business should send a 1099 form to an LLC vary, as does the 1099 form to send. Generally speaking, this is when LLCs should or should not receive a 1099: When a single-member LLC is taxed as a Sole Proprietorship or a multi-member LLC is taxed as a Partnership, any business that pays the LLC $600 or more for services in the year must send it a 1099-NEC (Nonemployee Compensation) form. If a business has sold $5,000 or more of consumer products to an LLC for...

The Alabama Business Start Up Guide

With a relatively low tax burden and low cost of labor, Alabama is the 14th fastest-growing state in the United States. It's becoming the sweetheart state for business start-ups. If you’ve been thinking about forming a business in Alabama, here is a comprehensive look at the many things business owners should know and address to get their new Alabama businesses up and running. 1. Fine-tune Your Business Idea Before spending time and money starting a business in Alabama, entrepreneurs should do their due diligence to ensure their business concept has the potential to succeed. A feasibility...

How to Legally Franchise a Business

If you've considered how to grow your business by leaps and bounds without starting and running dozens or hundreds of locations yourself, you may have wondered how to franchise a business. In this article, you'll learn more about what franchising means, how to determine if franchising makes sense for your business, and what's involved in franchising a business.

What is a C Corporation?

A C Corporation is a legal structure for a company that is authorized by the state to conduct business. Its owners, who are referred to as shareholders, are taxed separately from the business, and in most cases cannot be held personally responsible for business debt and legal issues. A C Corporation can have an unlimited number of owners, but not every C Corporation is a large company. Many small businesses incorporate and operate as C Corporations, which are known as general, for-profit corporations. If you hear someone talking about a corporation, they’re most likely referring to a C...

What Is a Publication Requirement?

Some states require business owners to publish a notice in a local newspaper after they form or make certain changes to their business entities. States’ publishing requirements help inform the public about new business entities and significant changes to existing entities. If you’re considering starting a business you’ll want to make sure you abide by your state’s publication requirement laws. States with business entity publication requirements include: Arizona (LLCs, Corporations) Georgia (Corporations) Nebraska (LLCs, Corporations) New York (LLCs) Pennsylvania (Corporations) Several...

Breaking Down Paycheck Withholdings and Deductions for Employees

Ready to hire? Becoming an employer is a big responsibility. One of your primary tasks is to pay and withhold the correct employment taxes, and you’re accountable for explaining that process to your employees. Here’s what you need to know about breaking down paycheck withholdings and deductions for your employees.

How Many LLCs Can You Have?

As an eager and enterprising entrepreneur, you may set your sights on multiple business ventures and wonder if one person can own multiple LLCs. Fortunately, no federal or state limits exist on the number of LLCs someone can own. However, aspiring business owners should know that other factors could prevent them from having ownership interest in multiple LLCs.

Eleven Disadvantages of Choosing a Sole Proprietorship

A Sole Proprietorship is the most popular business structure in the U.S., with nearly three out of four businesses operating as one. But if you’re running a Sole Proprietorship or thinking about starting a business that will operate as one, it’s important that you’re aware of some significant disadvantages to this business model. Let’s start by reviewing the basics of Sole Proprietorships, and then I’ll outline 11 disadvantages that might make you reconsider choosing that entity type for your company. How a Sole Proprietorship Operates A Sole Proprietorship is a simple business structure...

Payroll Taxes 101

Whether you’re a Sole Proprietor with only a handful of workers or a corporation with hundreds of employees, you are responsible for collecting and paying employment taxes to federal and state tax agencies. However, while federal payroll taxes are the same no matter where your business is located, state and local payroll taxes differ according to the jurisdiction’s laws and tax codes. Payroll taxes can be confusing and overwhelming to new business owners. In today’s article, I’ll break down the types of payroll taxes to help you understand what they are and what you need to consider....

As a Business Owner, Can I Have Multiple LLCs?

Once entrepreneurs taste what it's like to be their own boss and carve their own career path, some decide to pursue starting multiple businesses. Depending on the situation, owning multiple Limited Liability Companies (LLCs) might make sense. Which leads to the question, how many LLCs can someone have? The short answer is there are no particular limits on how many LLCs someone may form, provided they meet all of the eligibility criteria to be an LLC member and comply with all of the federal, state, and local government rules and regulations for operating an LLC. In this article, I’m going...

How to Proactively Manage Small Business Compliance

Besides going through all the proper steps to set up a business, understanding and following through with ongoing compliance requirements is immensely important. I regularly address small business compliance considerations in my writings on the CorpNet blog and webinars that I present to accounting and tax professionals. Compliance is mission-critical to entrepreneurial success, so in today's post, I am sharing a comprehensive list of many of the requirements business owners should be aware of. Realize that business compliance requirements vary depending on where a company is located, the...

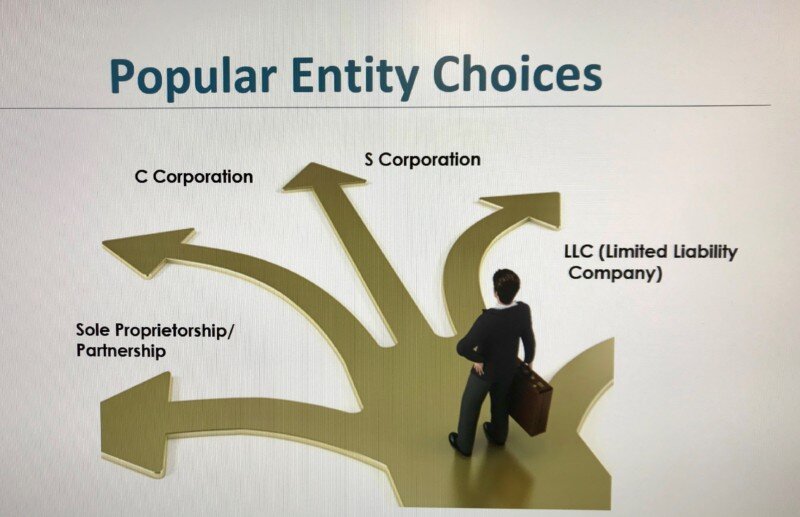

Tax Saving Features of Corporations, S Corporations, and LLCs

I regularly speak to business owners about entity types and their potential impact from a tax perspective. A while back, I created a webinar for accountants (and other professional services providers that work with businesses) on the topic of business structures and taxes. It is focused on the possible tax advantages and disadvantages of C Corporations, S Corporations, and Limited Liability Companies (LLCs). In this article, I’ll break down the important considerations that I discussed in that presentation. Benefits of Incorporating If you’re operating your business as a sole...

Webinars About How to Choose the Right Business Entity

Wondering how to choose the right business entity? Consider watching these webinars to learn about the pros and cons of various business structures.

How to Choose the Best State to Incorporate a Business

Besides the questions of when and how to start a company, many entrepreneurs want to know where to incorporate a business. Each state has its own business laws and tax codes, so deciding where to form an LLC or a corporation should not be taken lightly. I recently talked about this important topic in a webinar for accounting professionals hosted by CPA Academy. I want to share that information with you, too. It’s valuable food for thought whether you’re advising clients on their entrepreneurial journey or starting your own business. Considerations When Choosing a Business Structure Before...

How to Avoid Double Taxation as an LLC or S Corporation

There are a whole host of reasons to incorporate as a C Corporation. For example, the C Corporation is the preferred structure if you intend on seeking VC funding or taking the company public. However, forming a C Corporation involves more paperwork, legal fine print, and potential double taxation. In today's article, we'll review how you can utilize an S Corporation or LLC to avoid double taxation. S Corporation Considerations The biggest differences between forming a Limited Liability Company (LLC) and incorporating as an S Corporation arise when you start to look at the more complex...

How the Corporate Transparency Act Affects Your Company

Per the recently passed Corporate Transparency Act (CTA), owners of smaller Limited Liability Companies (LLCs) and corporations will soon have another compliance requirement to adhere to this year. LLCs and corporations with fewer than 20 employees must report information about their owners and company applicants to the federal government. What is the Corporate Transparency Act? The Corporate Transparency Act (CTA) is federal legislation created by the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) and passed by Congress as part of the Anti-Money...

Does Your Business Need a DBA?

Do you need a DBA for your business? It is a common question for evolving and growing businesses. Let's explore what a DBA is, what benefits it offers, and discuss some situations when you might need to file a DBA. What is a DBA? A DBA is a fictitious business name, trade name, or assumed business name. This DBA, which is short for Doing Business As, is a filing that lets the public know you’re the true owner of your business. In the United States, a DBA lets the public know who the real owner of a business is. The DBA is also called a fictitious business name or assumed business name. It...

How Many Members Can an LLC Have?

Besides personal liability protection, flexibility is among the top reasons entrepreneurs choose the Limited Liability Company (LLC) business structure for their companies. An LLC can have an unlimited number of owners, called “members” (with few restrictions on who can be a member); an LLC can override its default tax treatment and opt for an S Corporation or C Corporation tax election (if it meets the IRS’s qualification criteria); and an LLC can be managed by the LLC’s members or one or more designated managers. These qualities make operating as a Limited Liability Company attractive...

Can You File Your Own LLC?

Many entrepreneurs who want to form a Limited Liability Company (LLC) think they must hire a lawyer to handle the paperwork. They’re mistaken! While it’s helpful to consult an attorney about which business entity type is right for your business and get answers to other legal questions, you’re not required to have an attorney file your LLC’s Articles of Organization with the state. In fact, you may complete and submit your LLC registration paperwork on your own — or work with an online business filing company like CorpNet. Before I get into the filing requirements for LLCs, let’s revisit...

Professional Corporation vs. Professional LLC

A professional corporation and a professional LLC are business entities that licensed professionals may wish, or be required, to form. Generally, professions that form professional LLCs or professional corporations include: Attorneys and law firms Accountants and CPAs Physicians Engineers Architects Psychologists Chiropractors Dentists Veterinarians Social workers Real estate agents In this article, I'll explain some of the characteristics of the professional LLC (PLLC) and professional corporation (PC) business structures, show how they are similar, and show how they differ from each...

Which LLC Is Right for Me?

Just as there are flavors of ice cream, different varieties of the LLC business structure exist, too. The ideal option for a company may depend on a business's industry, type of commercial activities, number of owners, and even an owners' professional credentials. On the CorpNet website, we offer a tool to help entrepreneurs zero in on the right business entity for them. In this article, I'll describe some general scenarios and the limited liability company structure versions that might be most appealing in those situations. Keep in mind that choosing a business entity type requires...

The Top Reasons Startup Businesses Fail

No one starts a business to see it fail. Seeds of ideas slowly germinate into full-blown business plans bursting forth with sparkle and optimism. This business is your dream and you’ve given it your heart and soul. You know it won’t fail. I’m sorry to say that many startups do fail, and they fail for various reasons. Financial Issues Cash is the lifeblood of a new business. Without it, you can’t afford to pay your employees, purchase inventory and materials, or adequately market your business. You can’t even cover your overhead expenses like rent and utilities. The reasons for cash...

What is a Business Statement of Purpose for an LLC or Corporation?

When starting a Limited Liability Company or C Corporation, businesses in most states must provide a written statement of business purpose in their formation documents (Articles of Incorporation or Articles of Organization). The business purpose statement describes why, and for what legal purpose, will the business exist. This is not the same as a company's mission or vision statement, which businesses often leverage when seeking financing, attracting customers, and rallying employee morale. In most states’ Articles of Incorporation and Articles of Organization, the purpose statement is a...

How to Calculate Profit Margins

Passion, energy, and enthusiasm are essential entrepreneurial traits for launching a business — and so is an understanding of financial performance. To sustain and grow an LLC or Corporation, a business owner must keep an eye on its profitability. Calculating profit margin reigns as one of the most telling ways to assess a company's financial standing. What Is Profit Margin? Profit margin measures your company’s profitability after deducting expenses from its revenue. It’s expressed as a percentage — indicating the ratio of profit to revenue. For example, if your business has a 30% profit...

The Best CPA Marketing Channels for Growing Your Firm

Whether your accounting business is just starting out, or whether you’re a seasoned veteran, marketing your business is a must. It’s crucial in good economic times and in bad. In fact, during an economic downturn, choosing the right CPA marketing channels for your business matters more than ever. Smart marketing can give you the edge you need to succeed—if you know where to spend your time and money! Listed below are five CPA marketing channels sure to help grow your accounting business. 1. Direct Mail Along with huge accounting staff, huge accounting firms have huge budgets. How can you...