The Launch Blog: Expert Advice from the CorpNet Team

Benefits of Forming an LLC

The Limited Liability Company (LLC) business structure is a popular choice for entrepreneurs who want to protect their personal assets, enjoy tax and management flexibility, and keep corporate formalities to a minimum. In this article, I’ll discuss the main benefits of creating an LLC to help you understand why so many business owners choose this entity type for their companies. 7 Top Advantages of Registering an LLC 1. Simplicity The business registration paperwork to form an LLC is minimal, as are the ongoing filing requirements. It’s second only to the Sole Proprietorship and General...

What Is Reasonable Compensation for an S Corporation?

Operating a business as an S Corporation can provide some tax advantages for a company and its shareholders, but it also means complying with rules imposed by the Internal Revenue Service (IRS), including the need for employees to be given “reasonable compensation” for their work. There is a lot to unpack about S Corporations and the IRS rules that apply to them. Understanding some things about Limited Liability Company (LLC) and C Corporation taxes first can help you grasp how the S Corporation election works and why business owners might choose that option. In this article, I’ll cover...

Annual Report Requirements

Are you confused about your business' annual report requirements and if you need to complete one? You're not alone. Requirements for annual reports vary by state, so they can be a little intimidating for the average business owner. If your business is a Limited Liability Company (LLC), Corporation, Nonprofit Corporation, Limited Partnership, or Limited Liability Partnership, you will probably need to file an annual report with the state in which the business is registered. If your company is registered as a foreign entity in one or more states other than that in which it was formed, you...

Understanding the Various Types of LLCs

While you are familiar with the Limited Liability Company business entity, you may not realize there are different types of LLC business structures. In a recent live presentation to accounting and tax professionals, our own Amanda Beren walked through what an LLC is and the different types of LLCs in the U.S. If you missed it, fear not! You can watch it and I will cover the details in this article. The LLC is among the most popular entity types for many reasons. Still, before registering any entity, it’s critical for business owners to understand the nuances of the business structure so...

The Ultimate Buying a Business Checklist

If you aspire to start a business but are hesitant because of the risks, you’re wise to be cautious. According to recent U.S. Bureau of Labor Statistics data, nearly one in four new businesses fail within their first year of operation. But fear of failure doesn’t have to hold you back from your dream of owning your own business. Many entrepreneurs opt to buy an existing business instead of launching their own from scratch. Purchasing an established company can improve the chances of success for a variety of reasons: Financial history – With historical financial data about the business,...

Do I Need to Register an LLC and Obtain a Business License?

Many entrepreneurs assume that after going through all the steps of setting up and filing a Limited Liability Company (LLC) with the state, they’re free to begin doing business. While that assumption is understandable, it’s not correct. Before you can hang out your shingle and begin interacting with customers, you’ll need to obtain the business licenses you need to operate legally. You could need one or more business licenses at the federal, state, or local level—or possibly from two or even all those jurisdictions. A big part of owning and managing a business is being attentive to...

What to Expect When Selling Your Business

Deciding to sell a business you’ve worked hard to start and build is seldom an easy or hastily made decision, but the truth is that it happens all the time for a variety of reasons. Why would anyone want to sell something they’ve created? Maybe you are a serial entrepreneur at heart and you intended to grow the company to a certain point and then sell it, so you could make a profit and move on to another venture. Maybe you’ve had the business for a long time and you’re ready to retire and slow down so you can travel or spend more time with family and friends. It could be that you and a...

Advising Clients About Business Structures

With all the decisions your clients are expected to make when starting a business, which legal structure to choose might not get as much consideration as it should. Most business owners choose to form a sole proprietorship in the beginning, since it’s less paperwork and less costly; many switch entities as their business grows to benefit from the protections provided by a Limited Liability Company (LLC) or C Corporation. But an LLC or C Corporation can also choose to elect S Corporation status. If your clients come to you with questions about this option, here’s what to know: The C...

Incorporating a Business 101

As a business owner, the day will come when you inevitably will have to address the legal aspects of your business – and the sooner the better. And, fortunately, the process can be relatively painless and hassle-free. I talk to countless small business owners and freelancers who consider themselves too small to worry about incorporation. After all, you don't have mazes of cubicles…you may not even have any employees. However, incorporation can still be a smart idea even for the self-employed graphic designer or wedding planner and in this post we discuss the benefits of incorporating your small business.

Annual Report List by State for LLCs and Corporations

Many state governments require LLCs, Corporations, and other registered business entities to file annual reports each year. And some Secretary of State (or comparable agency) offices may require these types of reports to be filed according to different timeframes (e.g., biennial and decennial reports). This state-by-state list will help you prepare and stay in compliance.

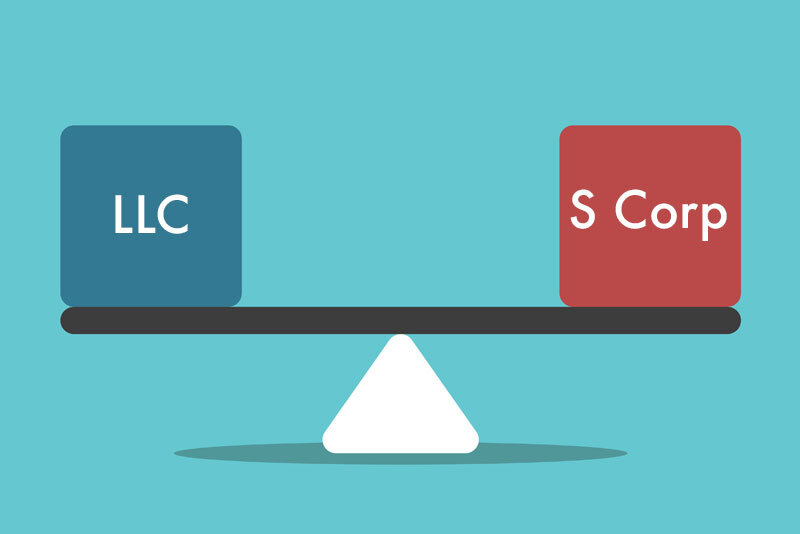

S Corporation vs. LLC

Limited liability companies (LLCs) and S Corporations are business structures that provide liability protection for business owners and allow for pass-through tax treatment. While they have those things (and some others) in common, they differ in several ways, too. If you’re starting a business or considering changing from a Sole Proprietorship or General Partnership to an S Corporation or LLC, it’s critical to understand the similarities and differences. Every business and business owner’s needs are unique in some respects, so I encourage entrepreneurs to do research on their own and...

Start a Small Business in Texas in 10 Steps

The Lone Star state attracts entrepreneurs because of its business-friendly environment, minimal tax burden, reasonable cost of living, robust infrastructure, and other factors. If you’ve been wondering how to start a small business in Texas, this article will walk you through some of the most important steps. As you explore entrepreneurship opportunities in Texas, make sure you seek the legal, accounting, and tax advice you need from licensed professionals. This article is for informational purposes only and is not meant as legal, tax, or financial guidance. 1. Write a Business Plan Have...

Can You Have Multiple Businesses Under One LLC?

There may come a time when you decide to expand your business into an additional area of focus or take an online business to a storefront (or vice versa). These shifting operations lead business owners to wonder if they can have multiple businesses under one LLC. The short answer is, yes, you can operate multiple businesses under one LLC. However, before you jump in, you have multiple options to consider. The route you choose can impact you in several ways (including your liability and tax obligations), so it's critical to do your homework and weigh the pros and cons. I recommend talking...

Increasing Client Satisfaction in Accounting Firms

What if you could increase customer satisfaction while increasing your revenue and profits? Even better, what if you could accomplish both objectives without increasing your workload or adding staff?In a recent webinar, we explored the benefits of helping clients manage the burden of incorporation, LLC formation, registered agent services, and annual compliance requirements. We also explored CorpNet’s Partner Program and showed how CPAs, accountants, and bookkeepers can easily add these services to their existing advisory offerings. I answered some excellent questions from the audience at...

Nexus and State Reciprocity

Nexus and state reciprocity are important topics for business owners and employees, as they can have tax implications for both parties. These topics might seem confusing until you understand the context in which they apply, so let’s break them down for a closer look. Having nexus means that a business is connected to a state in some way. When a business has nexus in a state, it can trigger the need for the business to register to collect and pay taxes there. But whether a business has nexus is not always clear, as there’s no common definition of what nexus is or what having it means....

CorpNet Awarded Inc. 5000 for 2024

CorpNet is proud to announce that it has made Inc.’s prestigious Inc. 5000 list in 2024 as one of the fastest-growing private companies in the country. This is the seventh year CorpNet has been honored. CorpNet's Inc. 5000 profile can be found here. "It is a honor to have our company named on the Inc. 5000 list! The 2024 recognition secures our seventh year and I am beyond proud of the team behind this award. As CorpNet rapidily grows our entire staff has continued to provide excellence in service and support to our customets. It's that dedication to the customer that makes me thrilled."...

When Do You Have Nexus in a State?

Every business that sells products and services beyond its home state or has a location in another state should understand the meaning of nexus. As a business owner, it is important that you know what nexus is, why it is important, and if you have nexus in other states. I recently presented a webinar on this topic for CPA Academy, and I want to share the information here as well. If you’re an accountant or tax advisor, knowing how to determine nexus in a state will help you when offering guidance to your clients. If you’re a business owner, having a grasp on nexus and its implications for...

Legal Requirements for Hiring Employees

Small businesses hire nearly half of all private sector employees in the United States, with about 61.6 million people working for more than 33 million businesses across the country, according to the U.S. Small Business Administration (SBA). If you’re a small business owner who has hired one or more employees, or you’re getting ready to add a new employee, you should be aware of some rules that apply to hiring and paying workers. Let me walk you through some important legal requirements to help you avoid mistakes when hiring employees. 1. Obtain an EIN Before hiring one or more...

Can I Use a Home Address for My LLC?

Using a home address to register an LLC or incorporate a business is something many entrepreneurs think about doing. That’s understandable because many new businesses start their journey in the entrepreneur's home or garage, which allows the business to avoid office rent, unnecessary utilities, and long commutes. This not only allows more time to focus on growth, but it can also help a company turn a profit faster as it ramps up. Does this lack of address impact the business negatively? Do you need a physical address for your business? Is it legal to use your home address for business...

What Is a Registered Agent?

Many business owners will ask themselves what is a registered agent and then question if they really need one. The answer to both questions is yes! A registered agent is a person or company with the authority to accept service of process (legal documents and government notices) on behalf of a business. When selecting a registered agent, the business must designate one who has a physical location within the state where the business is registered to operate. What Does a Registered Agent Do? A registered agent (also sometimes referred to as a resident agent or statutory agent) has an...

How to Legally Dissolve a Corporation or LLC

Just like life, running a business has its share of ups, downs, and surprises, which is why there are many different reasons why business owners may want to dissolve their LLC or Corporation. Dissolution, the act of formally dissolving (closing) a business entity with the state, involves far more than just ceasing to sell products and services. Dissolution is a process for wrapping up all legal and financial aspects of the business and legally terminating its existence in the state(s) where it is registered. Business owners and professional services providers who offer accounting, tax, or...

Creative Tax Deductions for Small Businesses

Paying taxes is a necessary task for small business owners, but there are ways to minimize the amount you must turn over to the government. While you’ve certainly heard of tax deductions, and hopefully are taking advantage of some, there are some lesser-known deductions you may not be aware of. Because many small business owners don’t take full advantage of the tax deductions they’re legally entitled to, I thought it would be a good idea to look at some creative deductions that apply to many small businesses. A Closer Look at Business Tax Deductions Small business owners who are busy...

Hiring Remote Employees in Another State

The number of employees working remotely increased dramatically in recent years, turning the traditional workplace model on its head. It’s estimated that by 2025, 22% of Americans will be fully remote. While many employees love the flexibility of working remotely, employers have discovered advantages in hiring remote workers, as well. Since those employees can work from anywhere, employers get the advantage of a bigger pool of potential workers. If employees work from different time zones, the workday can be extended for clients across the country. It also can save employers money on...

Legal Requirements for Hiring Out-of-State Employees

While hiring out-of-state employees can provide many benefits for your business, doing so presents some challenges you should consider before moving forward. Compliance laws vary, but every state has regulations pertaining to hiring, payroll, taxes, benefits, and other practices you’ll need to follow. If you plan to hire out-of-state employees, it’s a good idea to begin the process well ahead of time, as it requires preparation such as researching, communicating with state agencies, and preparing and filing applications. Registering for payroll tax in a different state can be particularly...

How to Keep Your LLC or Corporation in Good Standing

When you’re faced with the daily challenges of operating a business, details concerning compliance issues can easily be overlooked. You should be aware, however, that allowing that to happen can result in serious consequences. Once you’ve registered your Corporation, Limited Liability Company (LLC), or other business entity registered with the state, you’re responsible for complying with all applicable rules and regulations. Doing so is known as business compliance, or corporate compliance if your business is a corporation. Remaining in compliance enables you to run your business normally...

Setting Up Payroll for an LLC or Corporation

Payroll involves far more than just cutting a paycheck to employees. It entails calculating work hours, wages, salaries, benefits, wage garnishments, and withholding and paying employment-related taxes. So, what do business owners need to know about setting up payroll for an LLC or corporation? In today’s post, we’ll cover all of this and more. Seven Key Steps for Getting Started The account registrations needed, steps necessary, and forms required to set up and administer payroll are similar regardless of the business entity type. My recent article, What Is Payroll? offers detailed...

Nexus FAQs for Accountants and CPAs

As you work with business clients who sell their products and services over state lines, “nexus” is a little term with big implications. Recently, Milton Turcios, CorpNet’s VP of operations, hosted a Facebook Live event featuring Elisa Reyes, principal and CPA at the accounting firm HCVT, that addressed the topic of nexus. Below, we’ve assembled a list of helpful FAQs, inspired by the live event, to give you a go-to resource for answers to some of the questions you and your clients may have about nexus and how it affects a business’s tax responsibilities. For even more insight, I...

Noncommercial vs. Commercial Registered Agent

If you’ve been considering forming a business (or you’ve already started one), you’ve probably heard the term “registered agent” but may not be familiar with what it means. A registered agent is a designated party that a business has authorized to accept service of process (notice of lawsuits and other legal actions) and essential correspondence from the government on its behalf. Alternate names for a registered agent include statutory agent, resident agent, and agent for service of process. There are two types of registered agents: Commercial registered agent Noncommercial registered...

How Do I Legally Protect My Side Hustle?

With many people struggling to keep up with inflation and insufficient wage growth, side hustles are becoming increasingly common. In fact, MarketWatch, a website that provides business news, financial information, and stock market data, reported in May 2024 that 54% of Americans took on part-time jobs during the past year to supplement their primary incomes. A job on the side might help cover necessary expenses or provide some extra fun money, but there are some financial and legal implications you’ll need to consider if you’re thinking of getting started or already working in one. Legal...

What Is a Certificate of Authority?

The idea of a Certificate of Authority can be confusing, as the term has several different applications. The most common type of Certificate of Authority is a document that authorizes you to legally conduct business in a state other than where your company is based. Other types of Certificates of Authority are industry related and required for a specific purpose or to conduct business within a particular industry. In addition, I should note that while Certificate of Authority is a common name for this document, it varies from state to state. In California, for instance, the document is...