Whether you’re an accountant, tax advisor, coach, or consultant, your clients inevitably turn to you for insight into improving their business’s bottom line. One question they might ask is, “What is the best business structure?”

You need to be ultra-careful in advising customers about this because offering legal advice without a license to practice law is unlawful. However, you can give insight pertinent to your certified area of expertise and credentials, and of course, you may direct clients to the right resources for legal guidance.

And after a client has decided on a business structure, you can help them make the transition by preparing and submitting the necessary forms on their behalf. It is not considered the practice of law to file business registration and compliance paperwork for clients. Moreover, by doing so, you can increase revenue for your business and provide additional value and convenience to your customers.

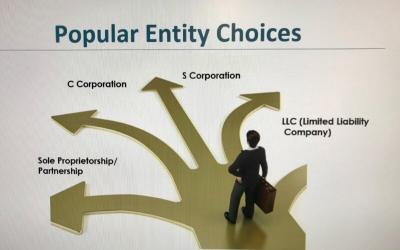

Let’s take a quick look at some of the considerations your clients must contemplate when selecting the best business structure to meet their needs.

Explore the Partner Program

The CorpNet Partner Program is perfect for accountants, bookkeepers, CPAs, QuickBooks Pro-Advisors, Enrolled Agents, lawyers, and tax professionals.

Key Factors to Consider When Choosing an Entity

- Owners’ Liability Risks – How much personal legal and financial risk an owner is willing to assume will influence which legal entity type to choose. Some types of businesses have a greater potential to run into litigious situations and significant debt than others. Formally registering a company as an entity separate from its owners offers a higher degree of personal liability protection than operating an unincorporated business.

- Tax Impact – How the IRS, states, and other tax authorities apply taxes to business profits varies according to a company’s legal structure. Some structures (known as pass-through entities) are set up to have taxes flow through to the business owner’s personal tax returns, while others result in the business paying taxes as its tax-paying entity. Under some structures, business owners pay a larger percentage of their earnings for Social Security and Medicare taxes. Your clients will want to weigh their options carefully to determine which scenario will offer them the best tax outcomes.

- Ownership and Management Flexibility – Different business structures have different ownership structures. When more than one owner is involved, things can get complicated, so it’s critical for clients to understand the advantages and disadvantages of their options.

- Growth Potential – Some structures are better suited than others for entrepreneurs who foresee needing to raise capital to fuel growth and expansion. In addition to considering the opportunity to sell stock, some structures generate more confidence and credibility when approaching investors and lenders.

- Costs and Complexity – Another detail business owners will want to keep top of mind is how much it will cost to file formation paperwork and fulfill ongoing compliance requirements. Some structures have simple and few obligations, while others come with more complicated (and costly) formalities.

- Succession Plan – Hopefully, your clients are also thinking about their business in the long term. What will happen to the business after they die? What if a business partner decides to leave the company? Some business structure types cease to exist after an owner passes away, while others live in perpetuity.

Business Structures Your Clients Might Register

Now that I’ve set the stage for what clients should think about, let’s look at a few of the most popular business entity types to give you more insight into each.

Sole Proprietorship

A one-person (or married couple’s) business will automatically be regarded as a Sole Proprietorship if it’s engaged in commercial activities but not registered as a business entity. A sole proprietorship doesn’t have to file formation paperwork with the state, nor does it have any formal compliance requirements to fulfill. However, it may need licenses and permits depending on the type of business it conducts and where it’s located. Also, if the owner chooses to use a fictitious name, it must file a DBA to provide products or services under a company name that doesn’t include the owner’s legal name(s).

A Sole Proprietorship is legally and financially considered the same entity as its owner. This means the owner is personally held liable for debts and legal obligations of the business. So, if the business can’t pay its bills or someone sues the company, the owner’s house, vehicles, bank accounts, and other property could be at risk. Another drawback of a Sole Proprietorship is limited financing opportunities. The company may not sell shares of stock, and lenders might not be interested in funding the business. So, sole proprietors may need to depend on their savings account, home equity loans, and assistance from family to fund big-ticket purchases like property, equipment, etc.

As an unincorporated business, a Sole Proprietorship reports its business profits on the owner’s individual income tax return. Because all income and losses flow through to the individual level, the owner must also pay 15.3% in self-employment taxes (12.4% Social Security and 2.9% Medicare taxes) on the business’s profits.

Partnership

A Partnership, when two or more people own a business, is an attractive option for entrepreneurs who want minimal compliance formalities. Like a Sole Proprietorship, a Partnership is an unincorporated business. Owners (partners) divide profits and report them on their individual income tax returns. Partners must also pay self-employment taxes on their share of the profits.

Partners typically work with an attorney to create a Partnership Agreement that sets forth how profits get divided and details about what happens if any of them retires, wants to get out of the business, declares bankruptcy, or dies. Some partnerships have a buy-sell agreement in place, as well, to ensure that the company can continue to operate if something happens to one of its partners or if a partner decides to leave.

Partnerships come in several varieties:

- General Partnership – The partners in a General Partnership manage the company and assume personal responsibility for the business’s finances and legal obligations.

- Limited Partnership (LP) – In a Limited Partnership, there are general and limited partners. While general partners take an active role in the business’s daily operations, limited partners typically have a financial interest without managing the business’s activities. The general partners are the owners who assume personal liability for the business.

- Limited Liability Partnership (LLP) – An LLP is similar to a Limited Partnership. The primary difference is that every partner has limited liability and is personally protected from the debts and legal issues of the business.

Limited Liability Company (LLC)

An LLC offers its owners (a.k.a. members) the benefit of limited personal liability while maintaining compliance simplicity. Some refer to it as a hybrid between a Sole Proprietorship and a Corporation.

A Limited Liability Company may be a single-member or a multi-member LLC (if more than one member). Multi-member LLCs can have an unlimited number of members. The business structure offers choices in how it’s managed. An LLC may be member-managed (its owners run the day-to-day operations) or manager-managed (the owners hire someone to manage it or appoint one or more of its members to handle business operations). LLC members usually create an LLC operating agreement defining individuals’ roles and responsibilities.

From a tax perspective, the IRS will view an LLC as a pass-through entity. As such, its profits and losses get passed through to its members rather than the company paying corporate taxes. Like owners of Sole Proprietorships and Partnerships, LLC members must pay self-employment taxes on business profits.

However, an LLC has some tax flexibility. Members can instead elect to be taxed as an S Corporation. I’ll explain more about S Corporation tax treatment later in this article, so keep reading!

With a single-member LLC, the business dies with the owner unless provisions in the LLC operating agreement state otherwise. Multi-member LLCs also may have a limited life if any members leave or pass away. Some states will require members to dissolve the LLC and form a new one with new members if there isn’t a buy-sell agreement establishing the rules for transferring ownership.

C Corporation

A Corporation, sometimes called a C Corporation, is a legal entity separate from its owners and provides the most personal liability protection for its owners (shareholders). C Corporations also may take some deductions that other business entity types may not. It costs more to incorporate than to form other business structures, and corporations have more oversight, record-keeping, and reporting responsibilities to stay in good standing and operate legally. Some compliance requirements that C Corporations must fulfill include designating a board of directors, holding directors’ and shareholders’ meetings, adopting bylaws.

Corporations may sell stock to raise funds. Because they are independent entities, they can remain active even when individual shareholders leave, die, or sell their shares of stock.

A C Corporation pays taxes on its profits, files its own income tax returns, and is legally liable. In many cases, corporate profits get taxed twice — something referred to as double taxation. When the company makes a profit, the Corporation pays tax at the corporate income tax rate, and then the profits paid as dividends to shareholders are taxed again on shareholders’ personal tax returns at the applicable income tax rates. If a C Corporation meets the eligibility requirements, it can elect S Corporation tax treatment to avoid double taxation.

In addition to the C Corporation, other forms of Corporations may be an option depending on the state where a company is registered:

- Benefit Corporation (B Corp) – A Benefit Corporation is a for-profit corporation that exists to serve a societal or environmental mission, contributing to the greater good in addition to generating a healthy bottom line. Examples of some well-known certified Benefit Corporations include Kickstarter, Ben & Jerry’s, and Patagonia.

- Closed Corporation – A Closed Corporation is usually run by a small group of shareholders without a board of directors. Rules vary by state, but typically, a Closed Corporation may not participate in public trading of stock.

- Nonprofit Corporation – A Nonprofit Corporation is organized for charitable, religious, educational, scientific, or literary work. It may apply to the IRS and state to be exempt from paying federal and state income taxes on its profits.

S Corporation

An S Corporation is a tax election option rather than a business structure in its own right. C Corporations and LLCs can elect to be treated as S corporations for tax purposes (by filing IRS Form 2553) if they meet IRS eligibility requirements.

Federal income tax obligations for an S Corporation pass through its owners. Therefore, C Corporations that choose the S Corporation election avoid double taxation because profits are taxed only at the shareholders’ personal level. The advantage for LLCs that elect S Corporation tax treatment is that not all business profit is subject to self-employment taxes. Instead, members pay themselves wages through the company payroll and only pay self-employment tax on that income. Profits paid to LLC members as distributions are not subject to Social Security and Medicare taxes. State rules for how taxes are applied to S Corporation profits vary.

S Corporations can have a maximum of 100 shareholders (or members in the case of an LLC), and other restrictions also apply. An LLC or C Corporation that chooses an S Corporation election must fulfill its underlying entity’s compliance requirements.

How to Help Your Clients Register a New Business

How can you help your clients make informed decisions while avoiding the risk of giving them guidance you’re not legally authorized to provide? First and foremost, ensure you only provide advice within your realm of expertise and the authority of your licensure and credentialing. So, as a licensed accountant or tax advisor, you may educate and advise on how a business structure will affect your clients’ tax obligations. However, you may not advise about the liability ramifications associated with any business entity type.

Examples of questions a licensed accountant can safely answer include:

- Will pass-through taxation, S Corporation tax treatment, or taxation as a C Corporation be most beneficial financially to a client who is forming an LLC?

- What options does a General Partnership have if its owners want to lower their self-employment tax burden?

- Which states offer the most favorable tax rates for a Corporation?

- What does the client need to do to register their business entity for payroll taxes?

- If a client has multiple businesses, how should they structure them for optimal tax outcomes?

Examples of questions when you should recommend clients seek the advice of an attorney:

- What are the personal liability advantages of changing from a Sole Proprietor to an LLC?

- What should clients include in their operating agreement?

- Which state will offer the most favorable legal environment for a corporation?

- Is the client legally responsible for submitting a BOI Report?

Enroll in the CorpNet Partner Program

Now that you have a basic understanding of what the types of questions you can answer and guidance you can give without venturing into the troubled waters of unauthorized practice of law, let’s explore how you can help your clients with their formation and compliance filings after they’ve decided on their ideal business structure.

As I mentioned earlier, it’s not considered the practice of law to file business documents for your clients. Fortunately, CorpNet has a program in place to allow you to assist your clients with business formation and compliance, opening a new stream of revenue for your business — with minimal effort on your part and at no cost to you. You can enroll for free in the CorpNet Partner Program as a Reseller or Referral Partner.

As a Reseller Partner, you can private label our services and offer incorporation, LLC formation, and corporate compliance filings in all 50 states. Our intuitive online portal makes it easy for you to submit requests, and CorpNet takes care of all the rest behind the scenes. Our portal also allows you to track filing and reporting deadlines, so you can help your clients stay on top of their upcoming responsibilities and offer your assistance as those due dates approach. You get discounted pricing on our services and then set your pricing to your clients as you wish.

As a Referral Partner, you refer your customers to CorpNet, and we work directly with them on their filings. You can earn a commission on the service value or request us to pass the savings to your clients instead.

Best of all, you can participate in both programs if you wish, selecting which services you want to resell and brand as your own and which you’d like to refer your clients directly to us for.

Here’s a list of some of the filings you can help your clients complete through the CorpNet Partner Program:

- Incorporation of C Corporations, Professional Corporations, Nonprofit Corporations (Articles of Incorporation)

- Registered Agent Designation (CorpNet provides Registered Agent Services in all 50 states)

- Business Name Searches and Reservations

- Fictitious Name Registration (DBA)

- Beneficial Ownership Reporting

- Business License and Permit Applications

- Foreign Qualification (to conduct business in other states)

- EIN Applications (IRS Form SS-4)

- 501(c)(3) Filings

- Initial and Annual Reports

- Sales and Use Tax Permit Registrations

- State Payroll Tax Registration (State Unemployment Insurance and State Income Tax)

- Articles of Amendment (changes in company name, address, etc.)

- Annual Meeting Minutes

- Entity Conversions (changing from one business entity type to another)

- Certificates of Good Standing

CorpNet even has customizable, turn-key marketing resources for digital and print marketing:

- Brochures and checklists

- Website content

- Email copy

- Digital banner ads for website and social media

Contact us today to learn more about the CorpNet Partner Program and the powerful way it will help you help your clients while boosting your business’s bottom line!

Explore the Partner Program

The CorpNet Partner Program makes offering incorporation, LLC formation, and annual corporate compliance filing services simple for accountants, bookkeepers, CPAs, QuickBooks Pro-Advisors, Enrolled Agents, lawyers, and tax professionals.