The Benefits of Incorporating a Business

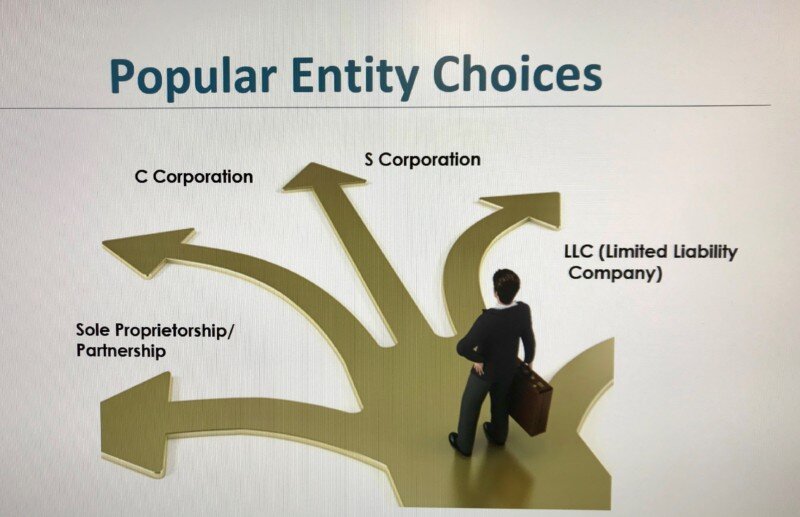

If you’re getting ready to launch a company or are already up and running as a Sole Proprietorship, you might be thinking about formally incorporating the business. Forming a Corporation might sound daunting, and it does require some actionable steps to get it...