Should You File a BOI Report Amid the CTA’s Questionable Constitutionality?

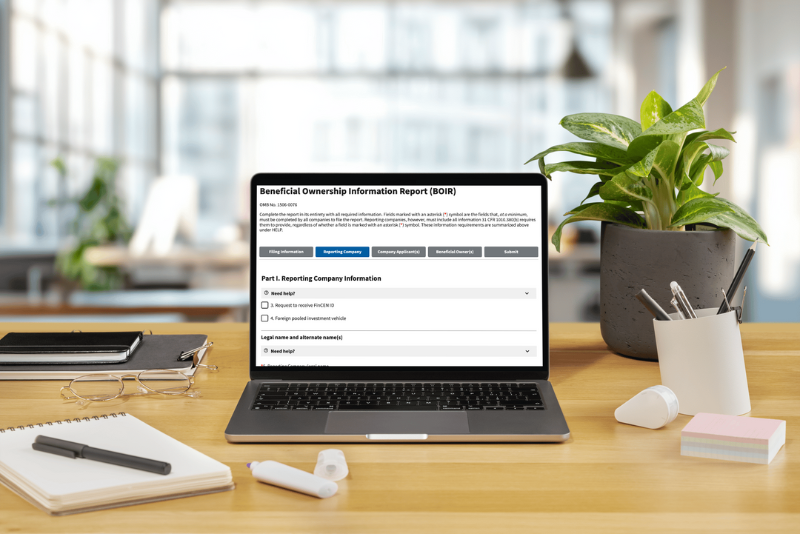

You’ve likely heard buzz about the U.S. District Court for the Northern District of Alabama’s March 1, 2024, ruling that the Corporate Transparency Act (CTA) is unconstitutional because it oversteps Congress’s legislative authority. As a result, plaintiffs in the...