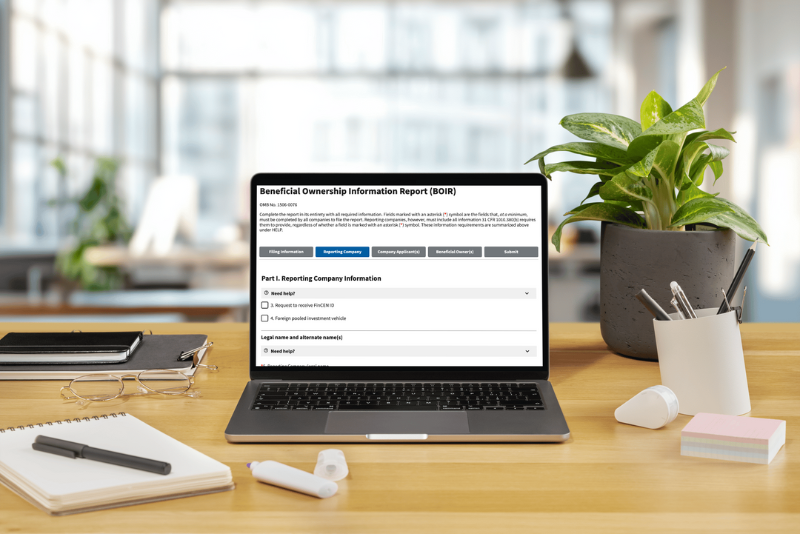

Federal Court of Appeals Reinstates Enforcement of BOI Reporting Requirement

Throughout the year, we have provided several updates about the 2024 Beneficial Ownership Information Reporting mandate. Recently, there’s another development you should be aware of. The temporary suspension of the BOI reporting rule has been lifted, and reporting...