If you have marketable skills and knowledge as a self-employed independent contractor, you may wonder if you should freelance, and if so, how you’d go about starting a freelance business. And with the current economic climate of the great resignation and possible recession, freelancing could be a viable option for ensuring financial stability.

And an even greater advantage to freelancing is that it brings a lot of benefits that include the flexibility to choose the type of work you do, the ability to decide who you work with, adjustable hours and the ability to set your own schedule, independence from supervisors, control over your workload, maximum authority over your work setting, and complete management of your rates and how much you earn on a weekly, monthly, or annual basis.

Freelancing isn’t for everyone or every situation. In today’s post, I’d like to cover my favorite tips for being a successful freelancer and review the steps to legally establish your new freelancing business.

Some Interesting Stats on Freelancing

According to Upwork’s Freelance Forward Economist Report, freelancing is alive and growing in popularity. The study, which was conducted by an independent research firm Edelman Data & Intelligence, surveyed 6,000 U.S. working adults over the age of 18 between August 27, 2021 – September 29, 2021. Of those who participated in the report, 2,156 were freelancers and 3,844 were non-freelancers. Below are some of my favorite data points in this report.

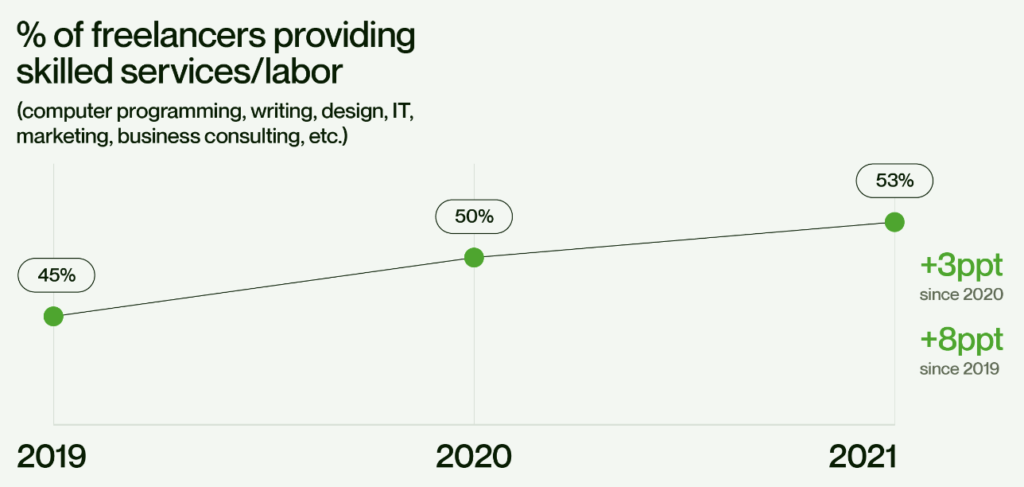

The Draw of the Skilled Freelance Worker

36% of the U.S. workforce did work on a freelance basis in 2021. The report also determined that the demand for skilled freelancers continues to grow year after year. From business coaches to bookkeepers to writers to graphic designers to personal trainers to IT consultants and more, all types of professionals have embraced freelancing as an opportunity to forge their own career paths.

Source: https://www.upwork.com/research/freelance-forward-2021

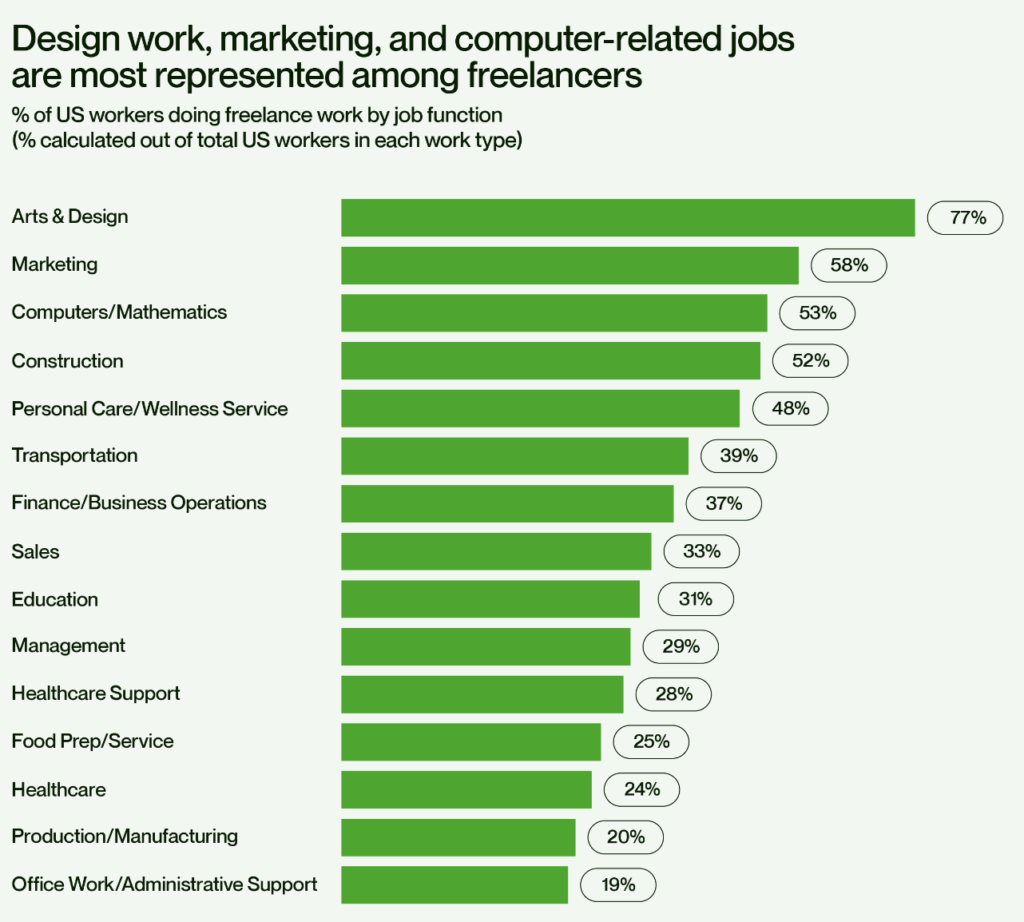

The Need for Design, Marketing, and Computer Freelancers

The type of skilled work performed by U.S. freelancers is heavily weighted towards the arts, graphic design, marketing areas (search engine optimization, email marketing, social media management), computers, and mathematical occupations.

Source: https://www.upwork.com/research/freelance-forward-2021

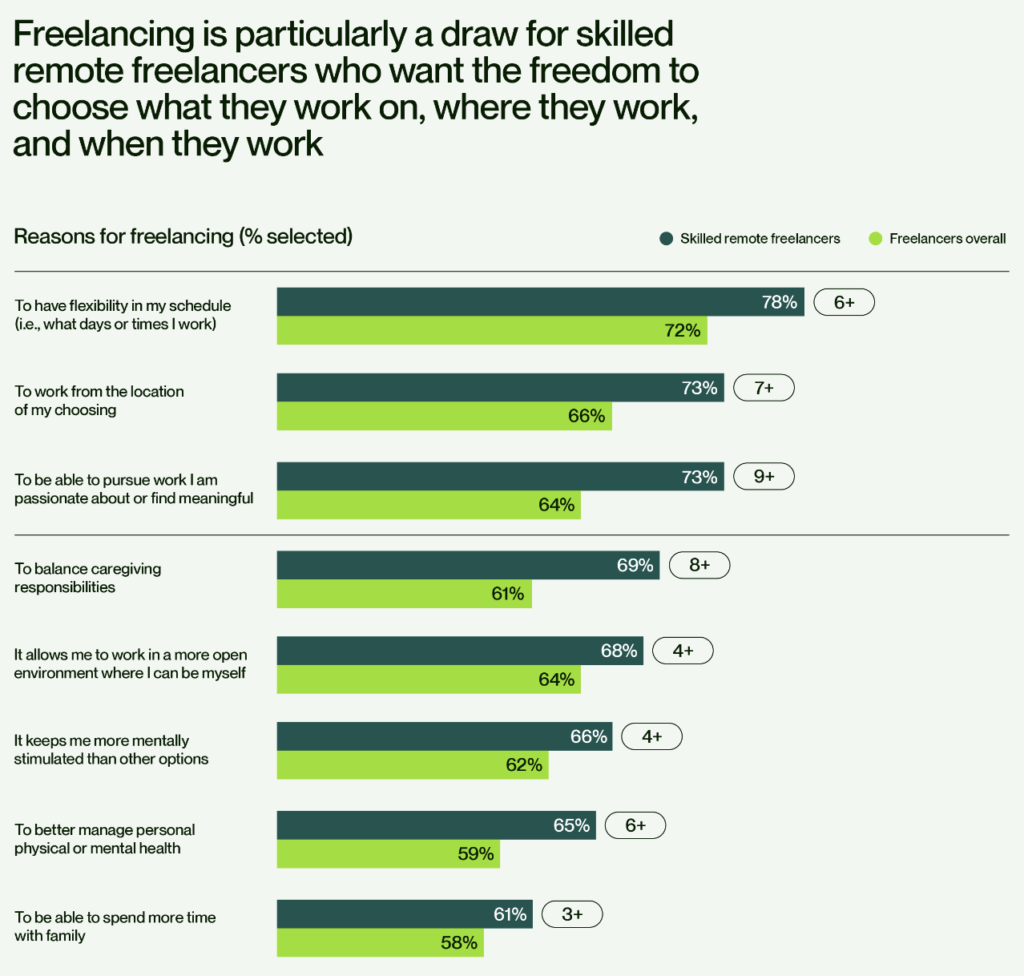

The Quest for Flexibility and Freedom

Flexibility and freedom of choice top the list of reasons for freelancing, however, mental stimulation, physical health, and the pursuit of family time also play an important role.

Source: https://www.upwork.com/research/freelance-forward-2021

As the generational shift occurs in the workforce, so does the attraction to starting a freelancing business. The Upwork survey shows that freelancing is more of a choice and less of a need. When asked, 63% of freelancers indicate if they had the choice, they would prefer to freelance over a traditional job.

My Tips for Achieving Freelance Success

My biggest recommendation for how to be a successful freelancer is to treat your freelance business like a business. From planning and research to consistent work hours and strong money management, your freelancing business can be a huge success if you operate it like a business. Below are some tips for doing so.

Do Your Due Diligence

It’s critical that aspiring freelancers research all the aspects involved in the particular type of freelance business they will operate and capture what they learn in a business plan. This due diligence allows for determining the costs associated with freelancing.

Examples of common freelancing costs:

- Office furnishings, equipment, and supplies such as a computer, workstation, monitors, paper, printer, business phone, etc.

- Software subscriptions such as accounting software, Microsoft applications, Google Workspace account, antivirus software, data backup solutions, etc.

- Marketing expenses such as website development, web hosting, business cards, networking, print advertising, etc.

- Tax obligations such as federal, state, and local income tax; Social Security and Medicare taxes, etc.

Researching the industry outlook and competitive landscape is essential, too. It enables you to assess the demand for your services and determine the going rate potential clients will be willing to pay.

Research and planning help illuminate the potential advantages and disadvantages of freelancing before you spend excessive time and money starting a freelancing business. As with any business endeavor, freelancing isn’t the right fit for everyone.

Manage Your Money

Creating a budget as a freelancer isn’t a glamorous task, but it’s important. While expenses may be relatively consistent and predictable, income might not be — especially for new freelancers who are building their client base and have more highs and lows in their workload. That makes it especially critical to manage money effectively.

Often, freelancers will use their personal assets to start their businesses. But going forward, it’s crucial to create a clear boundary between personal and business finances to avoid legal and tax issues down the road. The IRS has clear rules about whether a business is for profit versus a hobby. By keeping personal and freelance business finances separate, you can more effectively track your taxable business income and provide detailed, accurate information to the IRS. That’s especially helpful in a home office environment where the lines can potentially become blurred.

Among the best ways to maintain that separation is to set up a separate bank account for the freelance business and use a simple-to-use cloud-based accounting software solution (such as QuickBooks or FreshBooks) to track business income and expenses. They can be set up to sync with business bank and credit card records, enabling you to automatically import transactions rather than worry about manually adding all of them.

Manage Your Time

Many freelancers work from a home office. Working from home offers a great deal of convenience, but it can also bring a lot of distractions! Like other remote workers, freelance professionals may find it difficult to stay focused.

Productivity tips:

- Set boundaries with friends and family who don’t quite understand that freelance doesn’t mean free to chit-chat on the phone or free to drop everything and go out for coffee on a whim.

- Use an online calendar or planner to reserve time for client work and follow that schedule as closely as possible.

- Turn off the ringer and notifications on your mobile phone when working on assignments.

- Don’t let everyone pick your brain for free. As soon as you become a freelancer everyone will want to ask you questions or need small favors for free. This can eat away at your work hours quickly. Set up a Clarity.fm account so people can pick your brain on a pay-by-minute fee schedule.

- Take breaks. It may sound counterintuitive but taking regular breaks throughout the day helps refresh the mind and body. It improves the capacity to work — and do the work well.

Work-Life balance tips:

On the opposite side of the coin, freelancers may also find it challenging to turn off their work and enjoy time with family and friends.

- Set regular work hours so you know when you’re on the clock and when you’re free.

- Do not check work emails after a pre-determined time of day.

- Set expectations with clients about when you are or are not available.

- Take vacations. I know far too many small business owners who haven’t had a proper vacation in years.

Put Forth Effort to Market Yourself

A build it and they will come mindset rarely leads to success. Unless you take the initiative to get the word about your services, you may go unnoticed by potential customers.

Marketing tips for new freelancers:

- Network with other business professionals — This may involve attending industry events or joining business groups (like a local chamber of commerce). Doing so will help you form mutually beneficial connections and build awareness of your services.

- Create an active online presence — Create a professional website that is optimized for search. Create individual pages for each service you offer, so future clients can get a feel for what you offer and who you might help them. This will help new customers find you online.

- Create local business accounts on Google and Bing – Just because you’re independent, it doesn’t mean you’re not a business. And because you’re a business, you are eligible for creating business accounts on the map directories of Google and Bing. These profiles will help local companies know you exist and help them reach out to you for services.

- Clean up and optimize your social media accounts – When you are a freelancer, your social media accounts are open to future and current clients. And these companies will review your social accounts before and while working with you. Make sure they are professional and optimized for search within the social network.

- Understand and communicate your value proposition. Freelancers should have a firm grasp on what they do best (and better than other freelancers in their field). Presenting what you excel at will help you set yourself apart from your competitors.

Protect Your Assets

Running a business — even a very small one — comes with the risks of financial struggles and legal issues.

Some legal protection every freelancer needs:

- Create proper contracts – Services contracts spell out the freelancer’s and client’s responsibilities, pricing and payment terms, and other details about the working relationship. Make sure you have a solid contract in place prior to beginning your service work.

- Legally register your business – Business entity formation is crucial to legally separate the individual from the debts and liabilities of the business. Being a sole proprietor is not enough. You need to form an LLC or a C Corporation for maximum protection.

- Buy the right business insurance — The type of insurance you need will depend on the services performed. Common business insurance for freelancers includes general liability insurance, professional liability insurance, errors and omissions insurance, cybersecurity insurance, and business interruption insurance.

- Audit protection – Audit protection services provide professional support in the event of an IRS or other tax agency auditing your business.

Freelancers can benefit from talking with an attorney and accountant about ways to protect themselves.

8 Steps to Starting a Freelance Business

Now that you have some ideas for how to be successful in freelancing, let’s explore what it takes to get established. Below, I’ve listed some general steps for legally starting a freelance business. Realize other considerations may also apply as the process and requirements can vary depending on the type of freelance work and the freelancer’s location.

1. Choose a Business Name

Some freelancers opt to include their first and last name in their business name, such as Elana Cortez Photography Studio. When they do this, they can use the name without any special registration to claim the name. However, when getting more creative, such as Memories by Elana Photography Studio, name registration is required. The business owner must do so either through a fictitious name registration (also known as filing a DBA) or through forming an official business entity (which automatically registers the business name in the state).

Before deciding on a name, it’s critical to make sure it’s not already in use by another business that provides similar services in the state. A business name search and trademark search will help determine whether the name is available.

2. Decide on a Business Entity Type

Even though freelancers are one-person business owners, it’s wise for them to consider the benefits of forming an official business entity. To protect personal assets, many freelancers opt to create a state-registered business entity. Here’s a brief overview of the most common entity types.

- Sole Proprietorship – Some choose to operate as Sole Proprietorships, which is the easiest structure for freelancers to manage because of no business entity registration fees (aside from a DBA filing if using a fictitious name). In a Sole Proprietorship, the freelancer is the company from both tax and legal standpoints. Business income, losses, and tax obligations pass through to the freelancer’s personal tax returns. Simple, right? However, potential drawbacks exist. Most notably, the freelancer is responsible for all debts and legal claims against the business, which puts the individual’s assets at risk.

- Limited Liability Company – The Limited Liability Company (LLC) structure protects freelancers from business liability because it legally separates the business owner from the business. It has some characteristics of a sole proprietorship (such as pass-through taxation and minimal compliance requirements) and some traits of a corporation (legal protection for the owner and tax flexibility). An LLC protects the freelancer from personal liability in case of a legal judgment or debt. Also, an LLC has the flexibility to be taxed as a Sole Proprietorship (the default) or as an S Corporation or a C Corporation. With the default taxation, the freelancer’s business profits are reported on their personal tax return. They report and pay tax on all profits (usually quarterly), and net earnings are subject to Social Security and Medicare taxes (self-employment taxes). See below for information about taxation as an S Corp and C Corp. Forming an LLC involves filing paperwork called Articles of Organization with the state. Filing fees vary from state to state, and there may be other filing requirements as well. While not required, creating an LLC Operating Agreement is beneficial for demonstrating separation between the individual and the business.

- S Corporation – When freelancers anticipate making more money than they would in an equivalent full-time position as an employee, they may find it beneficial to be taxed as an S Corporation. An S Corporation is not a business entity type in and of itself but a tax election option available to eligible LLCs and Corporations. While business profits are subject to income tax and flow through to the individual’s tax returns (as is the case with a sole proprietorship), S Corp election allows a freelancer to split their earnings between wages (or a salary) and distributions of business profits. Only the business owner’s wages or salary are subject to Social Security and Medicare taxes; profit distributions are not. With S Corporation tax treatment, the freelancer must put themselves on the company payroll. Taxation as an S Corporation adds some extra work and filing complexity but reducing the freelancer’s Social Security and Medicare tax burden may make it worthwhile. Filing for the S Corporation election involves completing IRS Form 2553 (Election by a Small Business Corporation).

- C Corporation – Generally, freelancers choose not to form a C Corporation due to the entity’s extensive filing and compliance requirements and tax reporting considerations. The rules vary by state, but in addition to filing Articles of Incorporation to register the corporation, C Corporations must have bylaws and appoint a board of directors. In some states, corporations may have to file an Initial Report and Annual Reports. Most states also require holding shareholders and board of directors meetings at least once per year and recording written minutes from those meetings. Unlike LLCs and S Corps, C Corporations are separate tax filing entities from their owners. Business income and losses are reported on a corporate income tax return and profits are subject to the corporate income tax rate. The business owner files an individual tax return for wages or salaries and dividends that the corporation pays them. Corporate taxation is often called “double taxation” because some of the company’s income is taxed twice. Unlike wages and salaries, income paid as dividends are not tax-deductible for the business. Therefore, those earnings get taxed both at the corporate level and the individual tax-payer level.

It’s helpful for freelancers to discuss the options with an attorney and tax advisor to assess which structure will benefit them the most.

3. Designate a Registered Agent

LLCs and corporations must maintain a registered agent (sometimes referred to as a resident agent or statutory agent) to accept service of process (e.g., critical business compliance documents, tax notifications, and legal notices) on their company’s behalf. States’ business formation paperwork asks for registered agent information, so freelancers who form an LLC or corporation should decide on their registered agent before filing their state’s forms.

4. Register Your Business Entity

As I described above, states require freelancers to complete paperwork to legally register and start their business. They may also require other forms, filings, and formalities.

5. Obtain an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a federal tax ID number, akin to a Social Security Number for a business. Many banks and other financial institutions require that a business has an EIN before opening an account. Corporations must by law apply for an EIN, which the IRS uses to identify those business entities for tax purposes. The IRS also requires businesses (including sole proprietorships, partnerships, and LLCs) that hire employees to have an EIN. In some states, companies must also obtain a state-level tax ID number.

6. Open a Business Bank Account

As I mentioned earlier, it’s vital to keep business finances separate from personal monies. Therefore, having a business bank account is highly advisable for freelancers operating as a sole proprietorship, C Corporation, S Corporation, or Limited Liability Company. If they don’t, they could lose the liability protection those business structures provide to the business owner.

7. Apply for Business Licenses and Permits

Depending on a freelancer’s location, their profession, and the type of business activity they conduct, they may need licenses or permits to legally provide their services. Requirements may be necessary at the state, county, and local municipality levels.

Common types of licenses that freelancers may need to secure include:

- Professional or trade licenses to provide a specific service.

- General business license or permit to work in the city, county, or state.

- Sales tax permit if selling services or products subject to state or local sales tax.

- Payroll tax registration if a freelance business is set up as an S Corporation or a C Corporation, requiring the freelancer to be on the company payroll.

Some freelancers don’t have to get licenses, but it’s crucial to check thoroughly for licensing requirements before engaging in business.

8. Understand Your Business Compliance Obligations

After forming a business entity, it’s essential to keep it compliant with the state and local governments’ rules. If a freelancer fails to stay in compliance, they might lose their personal asset protection and be on the hook for fines and other penalties. The rules differ for LLCs and corporations and may vary from state to state.

Common LLC compliance requirements:

- Maintain a registered agent

- Renew business licenses and permits

- Pay quarterly income and self-employment taxes

- Report and pay sales tax

- File annual reports

Common C Corporation compliance requirements:

- Hold annual shareholders’ meetings and record minutes

- Hold annual board of directors meetings and record minutes

- Maintain a registered agent

- File annual reports

Start and Succeed with Expert Help

Is freelancing right for you? Talking with an attorney and accounting professional for specialized legal, tax, and financial expertise can help you answer that question.

After you’re ready to move forward, CorpNet’s team is here to help you with all of your formation paperwork and other startup and ongoing business filing needs. Put your freelance business on the path to success with CorpNet’s help!

CorpNet Can Help You Start Your Freelancing Business

If you’ve determined starting a freelancing business is right for you, we can help! From serving as your registered agent to filing your Articles of Organization to obtaining your EIN, and keeping you in compliance, we make the process simple and ensure your paperwork is completed accurately and promptly.