The Launch Blog

The CorpNet blog offers expert advice for launching and operating your business. From start up information to ongoing compliance, the CorpNet team keeps you up to date!

C Corporation vs. S Corporation

If you have your sights set on incorporating your business, you may be wondering if a C Corporation or S Corporation is the better option. While both are popular choices, nuances exist that may make one or the other more advantageous for your situation. The business structure you choose will affect your company in many ways, including the legal and financial aspects. That’s why it’s critical to do some research and ask for guidance from an attorney and accountant or tax professional when deciding. In this article, I’ll compare the C Corporation vs. the S Corporation. This review will help...

How to Choose the Best State to Incorporate a Business

Besides the questions of when and how to start a company, many entrepreneurs want to know where to incorporate a business. Each state has its own business laws and tax codes, so deciding where to form an LLC or a corporation should not be taken lightly. I recently talked about this important topic in a webinar for accounting professionals hosted by CPA Academy. I want to share that information with you, too. It’s valuable food for thought whether you’re advising clients on their entrepreneurial journey or starting your own business. Considerations When Choosing a Business Structure Before...

How to Transfer Business Ownership

If you’re considering retiring, looking for a new venture, or bringing a partner into your business, you may be wondering about the process of transferring business ownership. There are various ways to sell part or all of a business, and regulations you’ll need to adhere to as you move forward. Hopefully, you have instructions for the process outlined in the Bylaws or Shareholder’s Agreement created for your Corporation, or in the Operating Agreement of your Limited Liability Company (LLC). Whether your business is a Sole Proprietorship, Partnership, LLC, or Corporation, take care to...

Compliance Requirements for Hiring Remote Employees in Other States

Hiring remote workers as part of your team comes with a lot of advantages for both employers and employees. Employers who hire remote workers get access to a much larger pool of qualified employees than those who require in-person work. Instead of attracting applicants who live near your workplace, you can pick your hires from across the country, or even internationally. Studies have shown that employees who work remotely are more satisfied with their work situation and more productive than in-office workers. And employers save money by not having to maintain expensive office space. But...

Can I Set Up an LLC in Another State?

Yes, it is possible to set up a Limited Liability Company (LLC) in another state, and there are two possible scenarios for doing so: Form an LLC in a state different from where the business owner lives and works. Register an existing LLC formed in one state to conduct business in another state (a process called foreign qualification). An LLC is called a domestic LLC in the state where it was formed—i.e. where its owners (members) filed the entity’s formation paperwork. When an existing LLC’s members apply for foreign qualification to conduct business in one or more other states, the LLC...

What is a Series LLC?

The Series LLC is also known as a Series Limited Liability Company or SLLC for short. It allows multiple Limited Liability Companies (LLCs) within a master LLC to operate as separate entities with their own names, bank accounts, and record keeping. Each series can conduct business independently in this way because the series LLCs’ articles of formation explicitly allow them to have unrestricted segregation of membership interests, assets, liabilities, and operations. Different members and managers might run each series, and their rights and responsibilities might vary from series to...

CorpNet Awarded Inc. Pacific Regionals for 2025

CorpNet is proud to announce that it has made Inc.’s prestigious Inc. Regionals Pacific list in 2025 as one of the fastest-growing private companies in the country. This is the fourth year CorpNet has been honored in the regional awards. CorpNet's Inc. profile can be found at https://www.inc.com/profile/corpnet-.com. “I am beyond proud that CorpNet has been recognized by Inc. on their prestigious Regionals Pacific list for 2025. This is a true testament to the hard work, dedication, and passion of our incredible team. My husband, Phil, and I have always believed in continuous growth and...

How to Avoid Double Taxation By Using an LLC or S Corporation

There are a whole host of reasons to incorporate as a C Corporation and it is the preferred entity type if you intend on seeking VC funding or taking the company public. However, forming a C Corporation involves more paperwork, legal fine print, and potential double taxation. In today's article, we'll review how you can utilize an S Corporation or LLC to avoid double taxation. Understanding the Pitfalls of Double Taxation From a legal stance, a C Corporation is a separate entity that can sue and be sued. When it comes to taxes, a C Corporation is a separate taxpayer that files its own...

How to Start a Business in the USA as a Foreigner

The United States an ideal location for foreigners to start a business and capture that elusive American dream pushed so hard by the media and social media. It’s no wonder many international entrepreneurs dream about starting a business in the USA. Nonresidents can take advantage of the lower tax rates, enhanced legal protections, and a very strong economy. Neither citizenship nor residency is required to start a small business in the United States and the formation process is a lot easier than one might expect. Let's walk through the formation process and provide a checklist to get you...

Can You Have Multiple Businesses Under One LLC?

The short answer is, yes, you can operate multiple businesses under one LLC. However, before you jump in, you have multiple options to consider. The route you choose can impact you in several ways (including your liability and tax obligations), so it's critical to do your homework and weigh the pros and cons. Options for Operating Multiple Businesses Let’s take a look at three popular ways to structure multiple businesses and explore how each scenario works. 1. Use One LLC to Run Both Businesses One common approach involves having one Limited Liability Company (usually named for the...

Low Stress Options to Finance Your Business

Today’s business owners have more options for business financing than ever before. But some methods to finance your business may cause you to toss and turn at night more than others. Of course, stress can be subjective. One person’s definition of stress may be different from another’s. But this list can help you sort through the different ways to finance your business that are less likely to cause you stress or at least allow you to choose what you consider to be low stress. Here are some lower-stress financing options for your small business. Apply for Working Capital Loans Working...

Can I Use a Home Address for My LLC?

It is legal to use your home address for your LLC, C Corporation, or other business entity. You do need a physical address to register a business, but many sole proprietors and various types of professional services businesses don’t have a separate business location and they don't need one. When they decide to incorporate or form an LLC, they see using a home business address as a simple solution. Does this lack of address impact the business negatively? Do you need a physical address for your business? Is it legal to use your home address for business activities? And if you use a home...

All Domestic Business Entities Now Exempt from BOI Reporting

In a press release issued late in the day on March 21, 2025, the Financial Crimes Enforcement Network (FinCEN) announced an “interim final rule that removes the requirement for U.S. companies and U.S. persons to report beneficial ownership information (BOI) to FinCEN under the Corporate Transparency Act.” This announcement is the latest in a series of twists and turns concerning the controversial compliance requirement introduced to help detect and prevent crimes such as money laundering, tax fraud, financing terrorism, and other illegal activities. New “Reporting Company” Definition...

What is Payroll?

Payroll refers to the various tasks and responsibilities businesses must perform to pay their employees accurately and on time. It encompasses calculating wages and salaries; preparing checks or paying employees via direct deposit; withholding taxes and other deductions from employees’ pay; reporting and paying taxes to the appropriate federal, state, and local agencies; and more. Businesses must handle payroll correctly because it impacts their net income and can result in additional fines, fees, and penalties if not managed according to federal, state, and local rules. Because payroll...

Tax Saving Features of Corporations, S Corporations, and LLCs

I regularly speak to business owners about entity types and their potential impact from a tax perspective. A while back, I created a webinar for accountants (and other professional services providers that work with businesses) on the topic of business structures and taxes. It is focused on the possible tax advantages and disadvantages of C Corporations, S Corporations, and Limited Liability Companies (LLCs). In this article, I’ll break down the important considerations that I discussed in that presentation. Benefits of Incorporating If you’re operating your business as a Sole...

Tax Benefits of Incorporating

Tax implications are among the most important factors to think about when deciding on a business entity type. Some business owners are attracted to the simplicity of pass-through taxation, which is how a Sole Proprietorship, Ppartnership, LLC, and S Corporation are taxed. But for others, the tax benefits of incorporating as a C Corporation offer more financial advantages. A C Corporation is a business entity independent (both legally and from a tax perspective) of its owners (called shareholders). As such, the company is responsible for reporting its profits and losses on its own income...

Can Your LLC Have the Same Name as One in a Different State?

The name you choose for your Limited Liability Company (LLC) is important, as it conveys a first impression to potential customers and serves as the cornerstone of your brand identity. When selecting a business name it is important to remember that no two businesses registered within a state can share the same name. When considering a name for your LLC, you’ll need to conduct a search through the Secretary of State’s office to make sure another business in the state is not already using it. If it’s in use, you’ll need to choose another name. Laws regarding duplicate names of businesses...

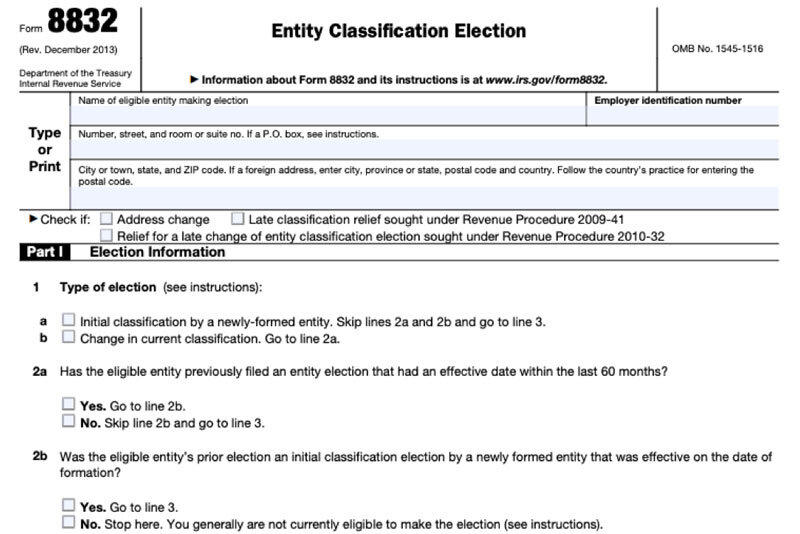

What Is IRS Form 8832?

IRS Form 8832 (Entity Classification Election) is the form an eligible business entity uses to elect federal income tax treatment other than its default treatment. Eligible entities include: Limited Liability Companies (LLCs) Partnerships (a business entity that has at least two members and is not a corporation) According to the IRS, a corporation is usually not considered an eligible entity unless: It is an eligible entity that previously submitted Form 8832 to be an association taxable as a corporation. The IRS may then allow it to use Form 8832 to change its classification. It is an...

Can a Minor Own an LLC?

There are stories all over the internet about kids and teenagers who have started businesses and are operating successfully as entrepreneurs. Sisters Caroline and Isabel Bercaw started making bath bombs in their basement in Minneapolis when they were 11 and 12 years old, eventually growing the highly successful business – Da Bomb – into a small empire. R.J. Duarte started cutting grass in Golden, Colorado when he was 8 and built a flourishing, high-end landscaping service by the time he was 18. And then there’s Cory Nieves, who started baking cookies as a young child and turned his...

What is a DBA?

A DBA - or Doing Business As is a name different from a company's legal name. It is also referred to as a trade name, assumed business name, or a fictitious business name. Typically, businesses use a DBA name when they want to market their products or services under a company name that’s more memorable or distinctive than their entity’s legal name. DBA laws requiring companies to register fictitious names are consumer protection regulations that provide transparency. They let the public know who is operating a business. DBA filings put information about the person or company who owns a...

The Best States to Form a Foreign LLC

While most entrepreneurs choose to register a Limited Liability Company (LLC) in the state where they live and plan to operate, some decide to expand their operations into one or more other states by registering it as a “foreign LLC”. The LLC is considered a “domestic LLC” in the state where it filed its entity formation paperwork (called Articles of Organization in most states). When an entrepreneur wants to expand their company beyond the borders of the state where they filed its formation paperwork, they may want (or be required) to register it as a foreign LLC in other states. The...

Small Business Tax Advice and Survival Guide

Tax season comes to all businesses big and small, and can be a headache no matter how well you think you’ve prepared. For a small business owner wearing many (or all) hats in the business, it’s an unwelcome extra task sure to cause late hours and frayed nerves. To handle the additional workload during tax season, CorpNet offers some small business tax advice and presents our Tax Season Survival Kit for business owners. Step 1. Gather All Necessary Documentation The first step in preparing for taxes is gathering any necessary documentation. Ask your tax accountant for the list of figures...

How to Create an LLC

A lot of new small business owners assume that creating an LLC is a complicated thing. It’s not, actually. But it is one of the best things you can do to protect your personal assets and your business. Let’s take a look at what it takes to set your business up as a Limited Liability Company: Choose a name - Your name will be the first thing people see or hear as it relates to your new business, so make it a good one (here you can find tips on coming up with a memorable name). Next, you want to make sure you’re the only one using that name. You can do that with a free corporate name search...

Should My LLC Be My Name?

If you’re starting a business and planning to operate it as a Limited Liability Company (LLC), you may be struggling to decide what to name your company. Should you include your personal name, or would it be better to register a more conceptual or catchy name as your LLC’s legal name? The short answer is: It depends. There is no right or wrong answer. Ultimately, as long as an LLC name complies with the state’s laws and no one else has already claimed it, whether you use your name for your LLC is a matter of preference and what will work best for your situation. Advantages of including...

Can a Single-Member LLC Be an S Corporation?

A single-member LLC can be taxed as an S Corporation if it meets the IRS’s eligibility criteria. In fact, both single-member and multi-member Limited Liability Companies can elect to be treated by the IRS as either an S Corporation or a C Corporation if they meet the requirements. IRS's S Corporation Qualification Criteria: Be a domestic corporation or an entity eligible to be treated as a domestic corporation. And not be an ineligible corporation (such as certain financial institutions, insurance companies, and domestic international sales corporations. Have only allowable shareholders...

What Happens When an LLC Owner or Member Dies?

Since a Limited Liability Company (LLC) can have one owner or an unlimited number of members, it’s not uncommon for an LLC to experience the death of one of its members. What happens to the ownership of the LLC when a member dies? First, let’s define some important terms: Probate occurs when someone dies, and their assets are distributed to pay their liabilities and beneficiaries. Stated another way, probate is a court-led, legal process that begins after someone passes away. The court will distribute their estate to the proper heirs. An executor is someone assigned to follow the deceased...

Nonprofit Corporation vs. 501(c)(3)

People often use the terms “nonprofit corporation” and “501(c)(3)” synonymously. However, they don’t necessarily mean the same thing, and it’s important to know the distinction if you plan to operate as a nonprofit organization. A Nonprofit Corporation is a state-registered business entity that exists for the public good or a charitable cause instead of the goal of generating profits and providing financial gains for its shareholders. Nonprofit Corporations do not have owners (shareholders), nor do they issue stock or pay dividends to individuals or other business entities. Registering as...

What Happens if You Fail to Submit Your Annual Report?

Nearly every U.S. state requires Limited Liability Companies, C Corporations, and other registered business entities to complete and file some form of an Annual Report. Annual Reports are intended to keep state officials up to date with contact information for your business and inform them of any important activities, such as the addition of directors or members or a change of your registered agent. Some states also require information about earnings and assets. The requirements for Annual Reports are specific to the state of formation. For example: The Annual Report may be called...

FinCEN Won’t Enforce BOI Reporting Fines or Penalties Until Further Notice

In a press release on February 27, 2025, FinCEN said that it “will not issue any fines or penalties or take any other enforcement actions against any companies based on any failure to file or update beneficial ownership information (BOI) reports pursuant to the Corporate Transparency Act by the current deadlines.” By Friday, March 21, 2025 (which is the current deadline for many reporting companies), FinCEN plans to issue an interim final rule to extend BOI reporting deadlines. The U.S. Treasury bureau will not fine or penalize anyone for not complying with BOI reporting requirements...

What Is a Pass-Through Entity?

A pass-through entity refers to a business that does not pay income tax of its own. Its income, losses, credits, and deductions “pass-through” to each business owner’s personal tax return, where its profits are taxed according to each owner’s individual income tax rate. Sole proprietorships, general partnerships, limited partnerships, limited liability partnerships, limited liability companies, and S Corporations are all pass-through entities. Corporations, and limited liability companies that elect to be taxed as a corporation, are not pass-through entities.